Latest News

Origin Bancorp, Inc. Reports Earnings For First Quarter 2021

RUSTON, Louisiana (April 28, 2021) - Origin Bancorp, Inc. (Nasdaq: OBNK) ("Origin" or the "Company"), the holding company for Origin Bank (the "Bank"), today announced record net income of $25.5 million for the quarter ended March 31, 2021. This represents an increase of $8.0 million from the quarter ended December 31, 2020, and an increase of $24.8 million from the quarter ended March 31, 2020. Diluted earnings per share for the quarter ended March 31, 2021, were $1.08, up $0.33 from the linked quarter and up $1.05 from the quarter ended March 31, 2020. Pre-tax, pre-provision earnings for the quarter were a record $32.9 million, an increase of 16.3% on a linked quarter basis, and a 74.7% increase on a prior year quarter basis, while the efficiency ratio improved to 54.5%, a 1,120 basis point improvement from the quarter ended March 31, 2020.

“Origin delivered strong first quarter results hitting another historic pre-tax, pre-provision earnings high and an all- time quarterly net income high” said Drake Mills, chairman, president and CEO of Origin Bancorp, Inc. “Our employees remain focused on relationship development and our results for the quarter prove that focus. We will continue to provide shareholder value as we execute on our long-term strategic plan and capitalize on the opportunities before us.”

Financial Highlights

- Net income was $25.5 million for the quarter ended March 31, 2021, achieving an all-time quarterly high

compared to $17.6 million for the linked quarter and $753,000 for the quarter ended March 31, 2020.

- Net interest income also achieved a historic quarterly high, reflecting $55.2 million for the quarter ended March 31, 2021, compared to $51.8 million for the linked quarter and $42.8 million for the quarter ended March 31, 2020.

- Provision expense was $1.4 million for the quarter ended March 31, 2021, compared to provision expense of $6.3 million for the linked quarter and $18.5 million for the quarter ended March 31, 2020.

- Total deposits at March 31, 2021, were $6.35 billion, an increase of $594.9 million, or 10.3%, from December 31, 2020, and an increase of $1.79 billion, or 39.3%, from March 31, 2020.

- Total LHFI were $5.85 billion at March 31, 2021, an increase of $125.0 million, or 2.2%, from December 31, 2020, and an increase of $1.37 billion, or 30.5%, from March 31, 2020.

Coronavirus (COVID-19)

Origin has continued to meet customers' needs while keeping the safety and well-being of its employees and customers as its top priority. While the Company allowed restricted access to its offices and branches during the height of the pandemic, the Company's offices and branches have been fully opened since March 15, 2021. Origin continues to maintain social distancing measures for its employees, including the requirement to wear face masks unless working in an office or other location that permits social distancing. The Company also continues to encourage its employees to wash their hands thoroughly and frequently and to sanitize work areas when necessary to promote the safety and health of its employees and customers. Thermal kiosks for temperature checks are in use at the entrance of each location and customers are encouraged to wear face masks when entering Origin bank facilities. The Company continues to provide pandemic Paid Time Off to employees and a dedicated hotline is available to quickly assist employees with any COVID-19 related questions or issues. Origin will continue to examine and evaluate its COVID-19 safety protocols in accordance with public health directives.

Credit Quality

The COVID-19 pandemic has had a severe impact on the U.S. economy leading to elevated unemployment levels and a recession. The Company's financial results for the first quarter of 2021 have improved from the results achieved during 2020, but there is still uncertainty surrounding the economic outlook.

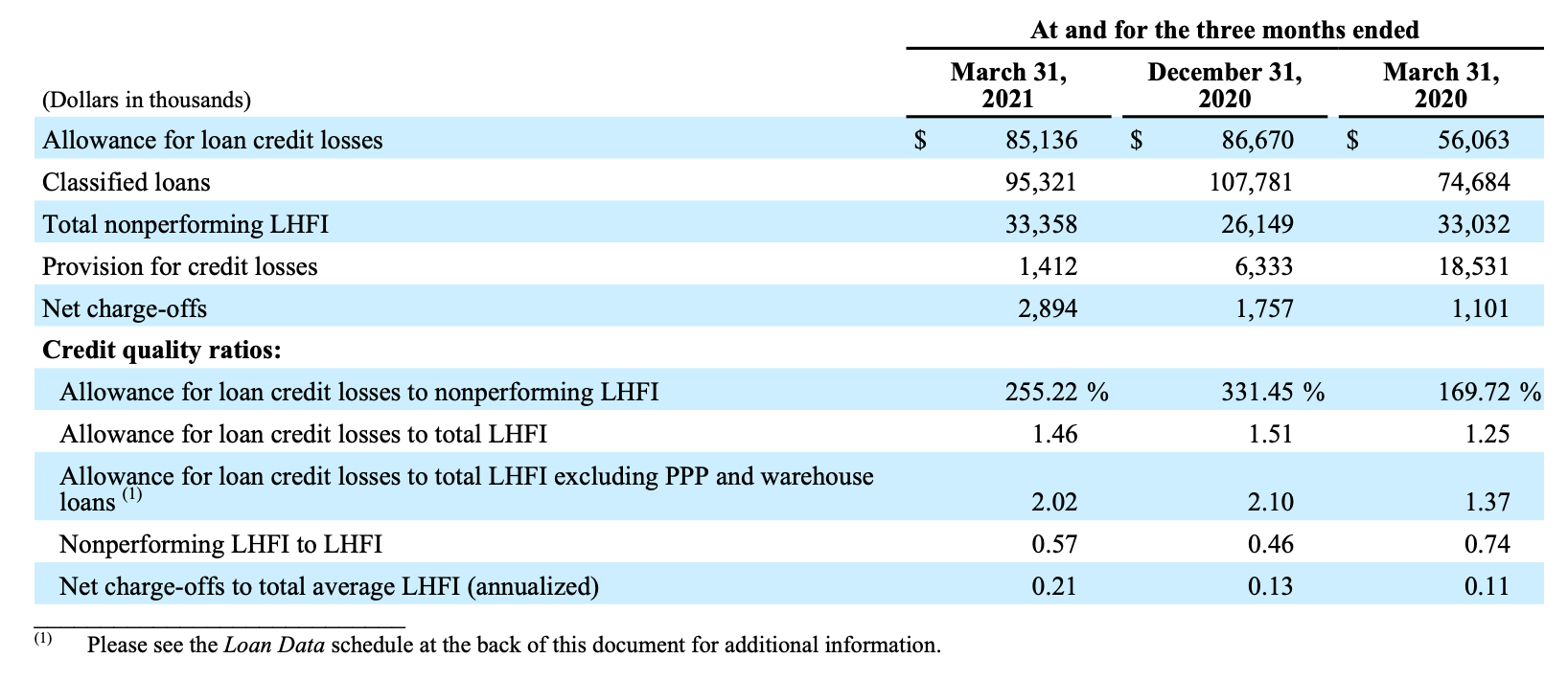

The table below includes key credit quality information:

The decrease in provision expense compared to the quarter ended March 31, 2020, was primarily due to improvement in forecasted economic conditions including the passing of additional government stimulus, widespread vaccine availability and reduced levels of new virus cases, at March 31, 2021, as compared to forecasted worsening economic conditions and uncertainty at March 31, 2020. While there are some improvements in economic forecasts, uncertainty remains particularly related to the 2021 year and the deployment and effectiveness of COVID-19 vaccines.

The Company's net charge-offs increased $1.1 million compared to the quarter ended December 31, 2020, and

$1.8 million compared to the quarter ended March 31, 2020. The increase in net charge-offs compared to the linked quarter was primarily due to five commercial and industrial loans, reflecting four loan relationships, that were written down during the quarter ended March 31, 2021, totaling $2.8 million. Annualized net charge-offs as a percentage of average LHFI were 0.21% for the quarter ending March 31, 2021, compared to 0.13% for the quarter ended December 31, 2020. For the year ended December 31, 2020, net charge-offs as a percentage of average LHFI was 0.22%.

Classified loans declined $12.5 million at March 31, 2021, compared to December 31, 2020, and represented 1.81% as a percentage of LHFI, excluding PPP loans, and 11.10% as a percentage of total risk-based capital (at the Origin Bancorp, Inc. level) compared to 2.08% and 12.88%, respectively, at December 31, 2020.

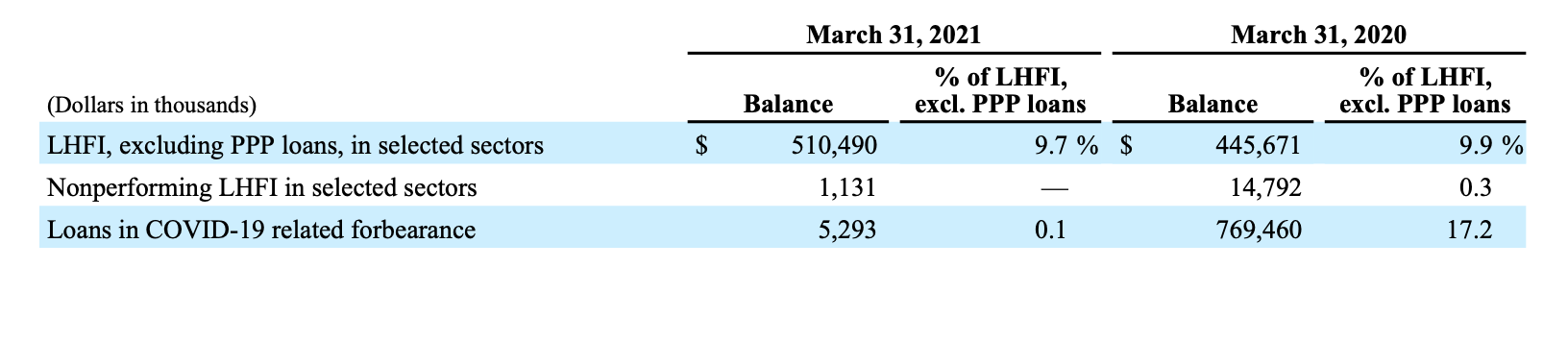

The Company continues to closely monitor those industry sectors that could experience a more protracted recovery from the current economic downturn, specifically the sectors of hotels, non-essential retail, restaurants, and assisted living ("selected sectors"). For more information on Origin’s COVID-19 selected sectors, please see the Investor Presentation furnished to the SEC on April 28, 2021, and on Origin's website at www.origin.bank under the Investor Relations, News & Events, Events & Presentations link.

The following table presents certain information on the selected sectors at the periods indicated:

Results of Operations for the Three Months Ended March 31, 2021 Net Interest Income and Net Interest Margin

Net interest income for the quarter ended March 31, 2021, was $55.2 million, an increase of $3.4 million, or 6.6%, compared to the linked quarter. The increase was primarily driven by a $2.8 million increase in accelerated PPP fee earnings earned through the forgiveness process and a $793,000 decrease in deposit costs. The yield on PPP loans was 4.40% during the quarter ended March 31, 2021, compared to 2.36% during the linked quarter ended December 31, 2020, driven almost exclusively by the accelerated recognition of deferred loan fees associated with the forgiveness of the underlying PPP loans by the U.S. Small Business Administration.

Interest-bearing deposit expense was $3.8 million during the current quarter, compared to $4.6 million for the quarter ended December 31, 2020, primarily due to a reduction in deposit rates. The average rate on time deposits decreased to 0.95% for the current quarter, down from 1.20% for the linked quarter, contributing $454,000 to the decrease in interest expense on interest-bearing deposits. The average rate on interest-bearing deposits was 0.37% for the current quarter, down from 0.43% for the linked quarter.

The fully tax-equivalent net interest margin ("NIM") was 3.22% for the current quarter, a 15 basis point increase from the linked quarter and a 22 basis point decrease from the quarter ended March 31, 2020. Excluding PPP loans, the fully tax- equivalent NIM was 3.15%, a two basis point decrease from the linked quarter. The impact on the fully tax-equivalent NIM of the recognition of deferred loan fees associated with the forgiveness of the underlying PPP loans during the quarter ended March 31, 2021, when compared to the fully tax-equivalent NIM for December 31, 2020, was 16 basis points. The yield earned on interest-earning assets was 3.58%, a 11 basis point increase and a 79 basis point decrease compared to the linked quarter and the quarter ended March 31, 2020, respectively. Excluding PPP loans, the yield earned on interest-earning assets was 3.51%, a six basis point decrease compared to the linked quarter. The rate paid on total interest-bearing liabilities for the quarter ended March 31, 2021, was 0.57%, representing a decrease of seven basis points and 80 basis points compared to the linked quarter and the quarter ended March 31, 2020, respectively.

Noninterest Income

Noninterest income for the quarter ended March 31, 2021, was $17.1 million, an increase of $1.8 million, or 11.4%, from the linked quarter. The increase from the linked quarter was primarily driven by increases of $1.4 million, $1.4 million and $1.0 million in gain on sales of securities, net, limited partnership investment income, and insurance commission and fee income, respectively, which was partially offset by a $2.0 million decrease in mortgage banking revenue.

The $1.4 million increase in the gain on sale of securities compared to the linked period was the result of the active management of the investment portfolio and the movement out of positions that were not performing in line with expectations.

The $1.4 million increase in the limited partnership investment income during the quarter ended March 31, 2021, compared to the linked quarter was primarily due to valuation increases as a result of investment performance in two funds.

The $1.0 million increase in insurance commission and fee income is attributed to seasonality, as there is typically higher insurance revenue in the first quarter of each year.

The $2.0 million decrease in mortgage banking revenue is mainly due to a decrease in the mortgage loan pipeline during the quarter ended March 31, 2021, when compared to the linked quarter in addition to an increase in 30 year mortgage rates causing the overall pipeline valuation to drop.

Noninterest Expense

Noninterest expense for the quarter ended March 31, 2021, was $39.4 million, an increase of $552,000, compared to the linked quarter. The increase from the linked quarter was largely driven by an increase of $1.5 million in other noninterest expense, which was partially offset by decreases of $428,000 and $203,000 in advertising and marketing expenses, and professional services fee, respectively.

The increase in other noninterest expense was due to prepayment fees of $1.6 million incurred related to the early termination of long-term FHLB advances during the quarter ended March 31, 2021. The Company terminated the advances early due to the relatively high cost of the advances, partially funding the payoff with the sale of lower yielding securities during the quarter.

The decrease in advertising and marketing expense was due to media related campaigns during the quarter ended December 31, 2020, which were not recurring in the current quarter.

The decrease in professional services fee was due to a $254,000 consulting fee paid to a loan sale advisor who assisted in the sale of a performing loan during the quarter ended December 31, 2020.

Financial Condition

Loans

- Total LHFI increased $125.0 million compared to the linked quarter and $1.37 billion compared to March 31, 2020.

- PPP loans, net of deferred fees and costs, totaled $584.1 million at March 31, 2021, an increase of $37.6 million

compared to the linked quarter. Net deferred loan fees and costs on PPP loans were $11.5 million at March 31, 2021.

- Average LHFI increased $193.6 million, compared to the linked quarter, and $1.53 billion compared to March 31,

Total LHFI at March 31, 2021, were $5.85 billion, reflecting an increase of 2.2% compared to the linked quarter and an increase of 30.5%, compared to March 31, 2020. The increase in LHFI compared to March 31, 2020, was primarily driven by an increase in mortgage warehouse lines of credit and PPP loans. Mortgage warehouse lines of credit increased by $653.1 million primarily due to increased mortgage activity driven by the continued low interest rate environment, coupled with additional mortgage warehouse clients being onboarded during mid-2020 and funding loans over the last four quarters. Mortgage warehouse loan growth has eased during the current quarter as mortgage interest rates have broadly started to increase from previous levels.

Deposits

- Total deposits increased $594.9 million compared to the linked quarter and increased $1.79 billion compared to March 31, 2020.

- Business depositors drove an increase of $398.5 million and $1.12 billion compared to the linked quarter and March 31, 2020, respectively.

- Average total deposits for the quarter ended March 31, 2021, decreased by $14.2 million over the linked quarter and increased $1.55 billion over the quarter ended March 31, 2020.

Total deposits at March 31, 2021, were $6.35 billion, reflecting an increase of 10.3% compared to the linked quarter and an increase of 39.3% compared to March 31, 2020. Money market, brokered and noninterest-bearing deposits increased by $333.8 million, $140.5 million and $129.0 million, respectively, compared to the linked quarter. Brokered deposits increased in response to changes in funding costs and sources over the current quarter. Historically, from time to time, the Company has used noncore funding sources, including brokered deposits, to support the increase in mortgage warehouse lines of credit and has shifted primarily between brokered deposits and FHLB advances, which may impact the balances in brokered deposits as funding costs and sources change.

Increases of $549.9 million and $508.0 million in money market business and noninterest-bearing business accounts, respectively, drove the increase in total deposits compared to March 31, 2020, primarily due to funds from government stimulus, including PPP loan funds.

For the quarter ended March 31, 2021, average noninterest-bearing deposits as a percentage of total average deposits was 29.0%, compared to 28.7% for the quarter ended December 31, 2020, and 25.4% for the quarter ended March 31, 2020.

Borrowings

- Average FHLB advances and other borrowings for the quarter ended March 31, 2021, increased by $210.3 million, compared to the quarter ended December 31, 2020, and increased by $243.2 million over the quarter ended March 31, 2020.

Average FHLB advances and other borrowings increased 60.5% for the quarter ended March 31, 2021, compared to the quarter ended December 31, 2020, and increased 77.3% compared to the quarter ended March 31, 2020. During the quarter ended March 31, 2021, the Company increased its short-term average FHLB advances to $278.1 million from $64.9 million during the quarter ended December 31, 2020. The increase was primarily due to shifts in funding costs and sources as the Company supports the ongoing mortgage warehouse loan growth. The Company prepaid $13.1 million in long-term FHLB advances during the quarter ended March 31, 2021, and incurred related prepayment fees of $1.6 million.

Stockholders' equity was $656.4 million at March 31, 2021, an increase of $9.2 million compared to $647.2 million at December 31, 2020, and an increase of $49.7 million compared to $606.6 million at March 31, 2020. The increase from the linked quarter was primarily due to net income for the quarter of $25.5 million, which was partially offset by the quarterly dividend declared and other comprehensive loss during the quarter ended March 31, 2021. Additionally, during the first quarter of 2021, the Company repurchased a total of 37,568 shares of its common stock pursuant to its stock buyback program at an average price per share of $33.42, for an aggregate purchase price of $1.3 million. The increase from the March 31, 2020, quarter was primarily caused by retained earnings and other comprehensive income during the intervening period.

Conference Call

Origin will hold a conference call to discuss its first quarter 2021 results on Thursday, April 29, 2021, at 8:00 a.m. Central Time (9:00 a.m. Eastern Time). To participate in the live conference call, please dial (844) 695-5516; International: (412) 902-6750 and request to be joined into the Origin Bancorp, Inc. (OBNK) call. A simultaneous audio-only webcast may be accessed via Origin's website at www.origin.bank under the Investor Relations, News & Events, Events & Presentations link or directly by visiting https://services.choruscall.com/links/obnk210429.html.

If you are unable to participate during the live webcast, the webcast will be archived on the Investor Relations section of Origin's website at www.origin.bank, under Investor Relations, News & Events, Events & Presentations.

About Origin Bancorp, Inc.

Origin is a financial holding company headquartered in Ruston, Louisiana. Origin's wholly owned bank subsidiary, Origin Bank, was founded in 1912. Deeply rooted in Origin's history is a culture committed to providing personalized, relationship banking to its clients and communities. Origin provides a broad range of financial services to businesses, municipalities, high net-worth individuals and retail clients. Origin currently operates 44 banking centers located from Dallas/ Fort Worth and Houston, Texas across North Louisiana and into Mississippi. For more information, visit www.origin.bank.