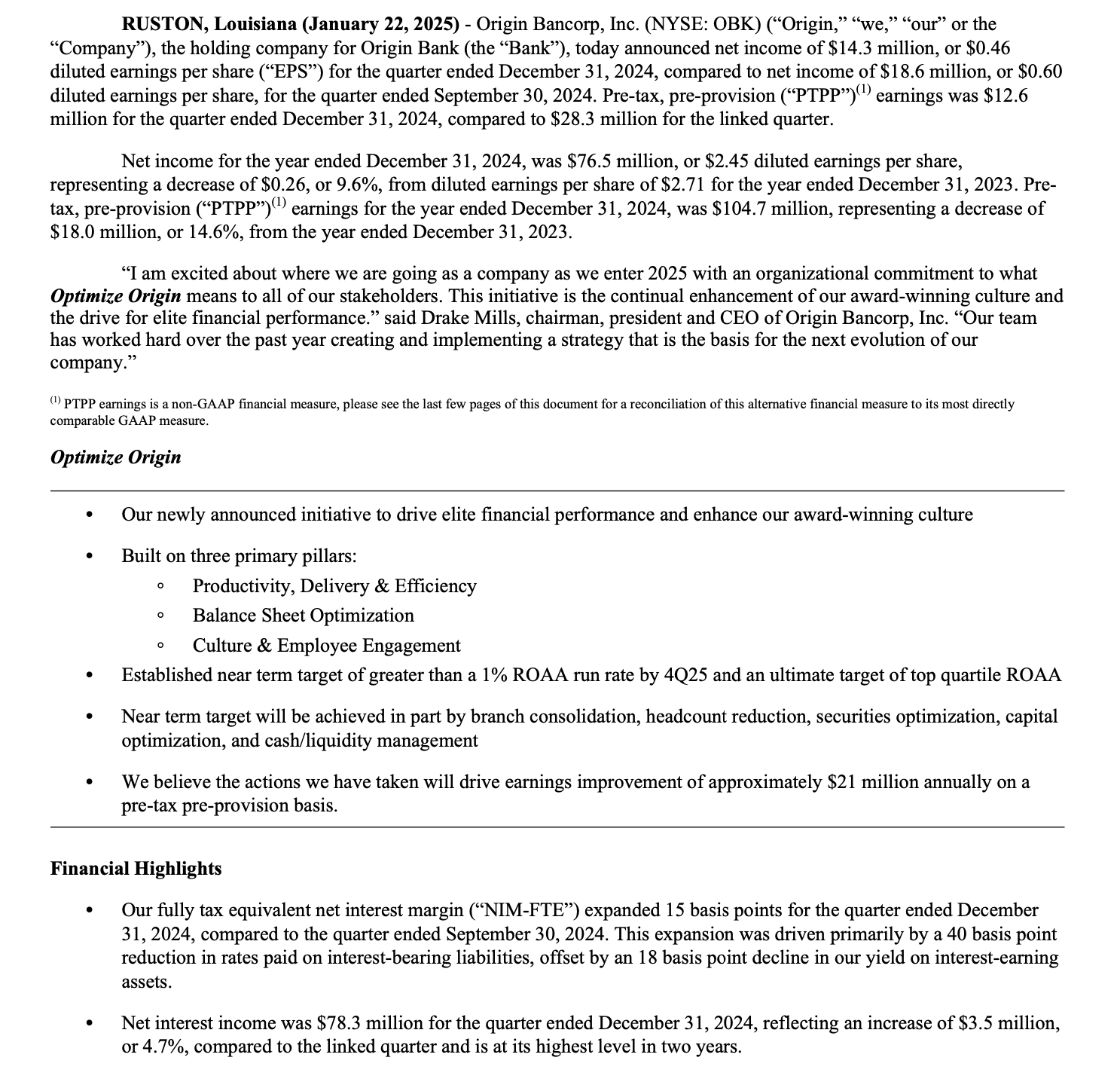

Origin Bancorp, Inc. Reports Earnings for First Quarter 2023

Origin Bancorp, Inc. (Nasdaq: OBNK) (“Origin” or the “Company”), the holding company for Origin Bank (the “Bank”), today announced net income of $24.3 million, or $0.79 diluted earnings per share for the quarter ended March 31, 2023, compared to net income of $29.5 million, or $0.95 diluted earnings per share, for the quarter ended December 31, 2022, and compared to net income of $20.7 million, or $0.87 diluted earnings per share for the quarter ended March 31, 2022. Adjusted pre-tax, pre-provision ("adjusted PTPP")(1) earnings were $36.6 million, for the quarter ended March 31, 2023.

“We manage this company for long-term success, and we are confident in both the strength of this company and the experience of our management team to continue to deliver meaningful value to our employees, customers, communities and shareholders,” said Drake Mills, chairman, president and CEO of Origin Bancorp, Inc. “Just as we have in the past, we are in a position to take advantage of the opportunities presented during these times.”

(1) Adjusted PTPP earnings is a non-GAAP financial measure, please see the last few pages of this document for a reconciliation of this alternative financial measure to its comparable GAAP measure.

Financial Highlights

• Total loans held for investment ("LHFI"), excluding mortgage warehouse lines of credit, were $7.04 billion at March 31, 2023, reflecting an increase of $233.1 million, or 3.4%, compared to December 31, 2022.

• Total deposits were $8.17 billion at March 31, 2023, reflecting an increase of $398.6 million, or 5.1%, compared to December 31, 2022.

• Book value per common share was $32.25 at March 31, 2023, reflecting an increase of $1.35, or 4.4%, compared to the linked quarter, and an increase of $3.75, or 13.2%, compared to March 31, 2022. Tangible book value per common share(1) was $26.53 at March 31, 2023, reflecting an increase of $1.44, or 5.7%, compared to the linked quarter, and an increase of $0.16, or 0.6%, compared to March 31, 2022.

• Total nonperforming LHFI to total LHFI was 0.23% at March 31, 2023, compared to 0.14% at December 31, 2022, and 0.41% at March 31, 2022. The allowance for loan credit losses ("ALCL") to nonperforming LHFI was 538.75% at March 31, 2023, compared to 876.87% and 293.53% at December 31, 2022, and March 31, 2022, respectively.

• At March 31, 2023, and December 31, 2022, Company level common equity Tier 1 capital to risk-weighted assets was 11.08%, and 10.93%, respectively, the Tier 1 leverage ratio was 9.79% and 9.66%, respectively, and the total capital ratio was 14.30% and 14.23%, respectively. Tangible common equity to tangible assets(1) was 8.02% at March 31, 2023, compared to 8.11% at December 31, 2022, and 7.77% at March 31, 2022.

• LHFI, excluding mortgage warehouse lines of credit, to deposits was 86.1% at March 31, 2023, compared to 87.5% at December 31, 2022, and 69.3% at March 31, 2022. Cash and liquid securities as a percentage of total assets was 14.3% at March 31, 2023, compared to 12.1% and 23.0% at December 31, 2022, and March 31, 2022, respectively.

(1) Tangible book value per common share and tangible common equity to tangible assets are non-GAAP financial measures, please see the last few pages of this document for a reconciliation of these alternative financial measures to their comparable GAAP measures.

Results of Operations for the Three Months Ended March 31, 2023

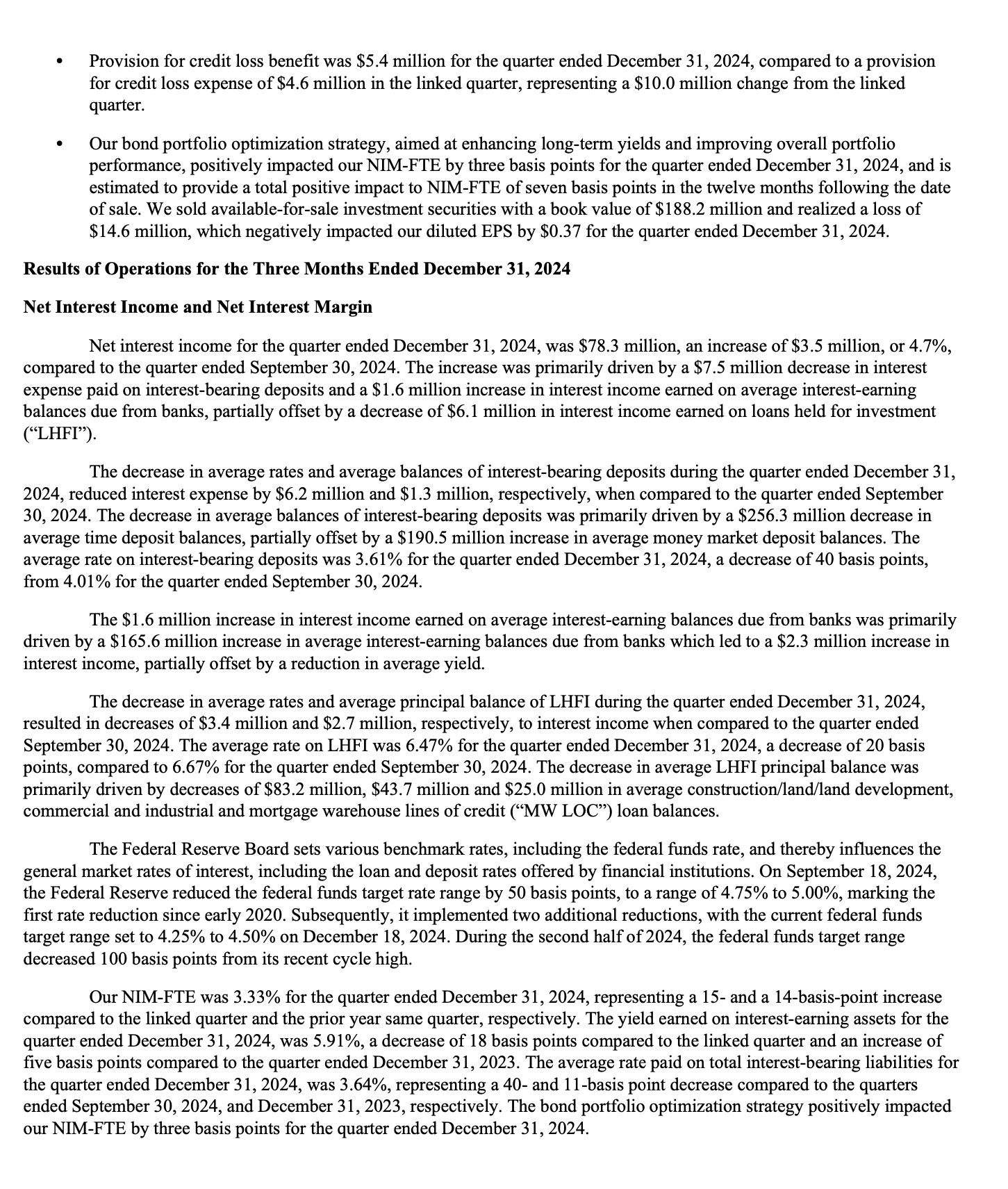

Net Interest Income and Net Interest Margin

Net interest income for the quarter ended March 31, 2023, was $77.1 million, a decrease of $7.6 million, or 9.0%, compared to the linked quarter, due to a $16.4 million increase in total interest expense, partially offset by an $8.8 million increase in interest income. Increases in interest rates increased our total deposit interest expense and FHLB advances and other borrowings interest expense by $12.9 million and $2.4 million, respectively. Offsetting this increase in deposit interest expense, was a $5.2 million increase in interest income earned on total LHFI due to rate increases, during the current quarter compared to the linked quarter. Increases in interest rates drove a $5.7 million increase in total interest income, while increases in average interest-earning asset balances drove a $3.1 million increase in total interest income.

The net purchase accounting accretion declined to $1.7 million, a decrease of $194,000, for the three months ended March 31, 2023, compared to the three months ended December 31, 2022. The table below presents the estimated loan and deposit accretion and subordinated indebtedness amortization resulting from merger purchase accounting adjustments for the periods shown.

The Federal Reserve Board sets various benchmark rates, including the Federal Funds rate, and thereby influences the general market rates of interest, including the loan and deposit rates offered by financial institutions. In early 2020, the Federal Reserve lowered the target rate range to 0.00% to 0.25%. These rates remained in effect throughout all of 2021. On March 17, 2022, the target rate range was increased to 0.25% to 0.50%, then subsequently increased six more times during 2022 and two more times during 2023, with the most recent and current Federal Funds target rate range being set on March 2, 2023, at 4.75% to 5.00%. By March 31, 2023, the Federal Funds target rate range had increased 450 basis points from March 17, 2022, and in order to remain competitive as market interest rates increased, interest rates paid on deposits have also increased.

The average rate on interest-bearing deposits increased to 2.49% for the quarter ended March 31, 2023, compared to 1.54% for the quarter ended December 31, 2022, and average interest-bearing deposit balances increased to $5.63 billion from $5.12 billion for the linked quarter. Average balances in savings and interest-bearing transaction accounts increased $285.5 million compared to the linked period, while average time deposit balance increased $223.4 million compared to the three months ended December 31, 2022. Offsetting these increases was a decline of $201.1 million in average noninterest-bearing deposit balances.

The average rate on FHLB advances and other borrowings increased to 5.21% for the quarter ended March 31, 2023, compared to 3.02% for the linked quarter. Additionally, the yield on LHFI was 6.03% and 5.63% for the quarter ended March 31, 2023, and December 31, 2022, respectively, and average LHFI balances increased to $7.15 billion for the quarter ended March 31, 2023, compared to $6.97 billion for the linked quarter. The yield on LHFI, excluding the purchase accounting accretion, was 5.94% for the quarter ended March 31, 2023, compared to 5.53% for the linked quarter.

The Company made a strategic decision to borrow approximately $700.0 million and hold excess cash for contingency liquidity for the majority of the month ended March 31, 2023. This excess liquidity was held at a weighted-average rate of 5.03% and added $1.9 million in interest expense for the quarter ended March 31, 2023, which negatively impacted the fully tax-equivalent net interest margin ("NIM") by six basis points.

The fully tax-equivalent NIM was impacted by margin compression as rates on interest-bearing liabilities rose faster than yields on interest-earning assets during the current quarter. We typically lag market deposit rate increases. The fully tax- equivalent NIM was 3.44% for the quarter ended March 31, 2023, a 37 basis point decrease and a 58 basis point increase compared to the linked quarter and the prior year quarter, respectively. The yield earned on interest-earning assets for the quarter ended March 31, 2023, was 5.31%, an increase of 35 and 218 basis points compared to the linked quarter and the prior year quarter, respectively. The average rate paid on total deposits for the quarter ended March 31, 2023, was 1.75%, representing a 73 and a 158 basis point increase compared to the linked quarter and the prior year quarter. The average rate paid on FHLB and other borrowings also increased to 5.21%, reflecting a 219 and 354 basis point increase compared to the linked quarter and prior year quarter, respectively. The net increase in accretion income due to the BTH merger increased the fully tax- equivalent NIM by approximately eight basis points for both the current quarter and the linked quarter.

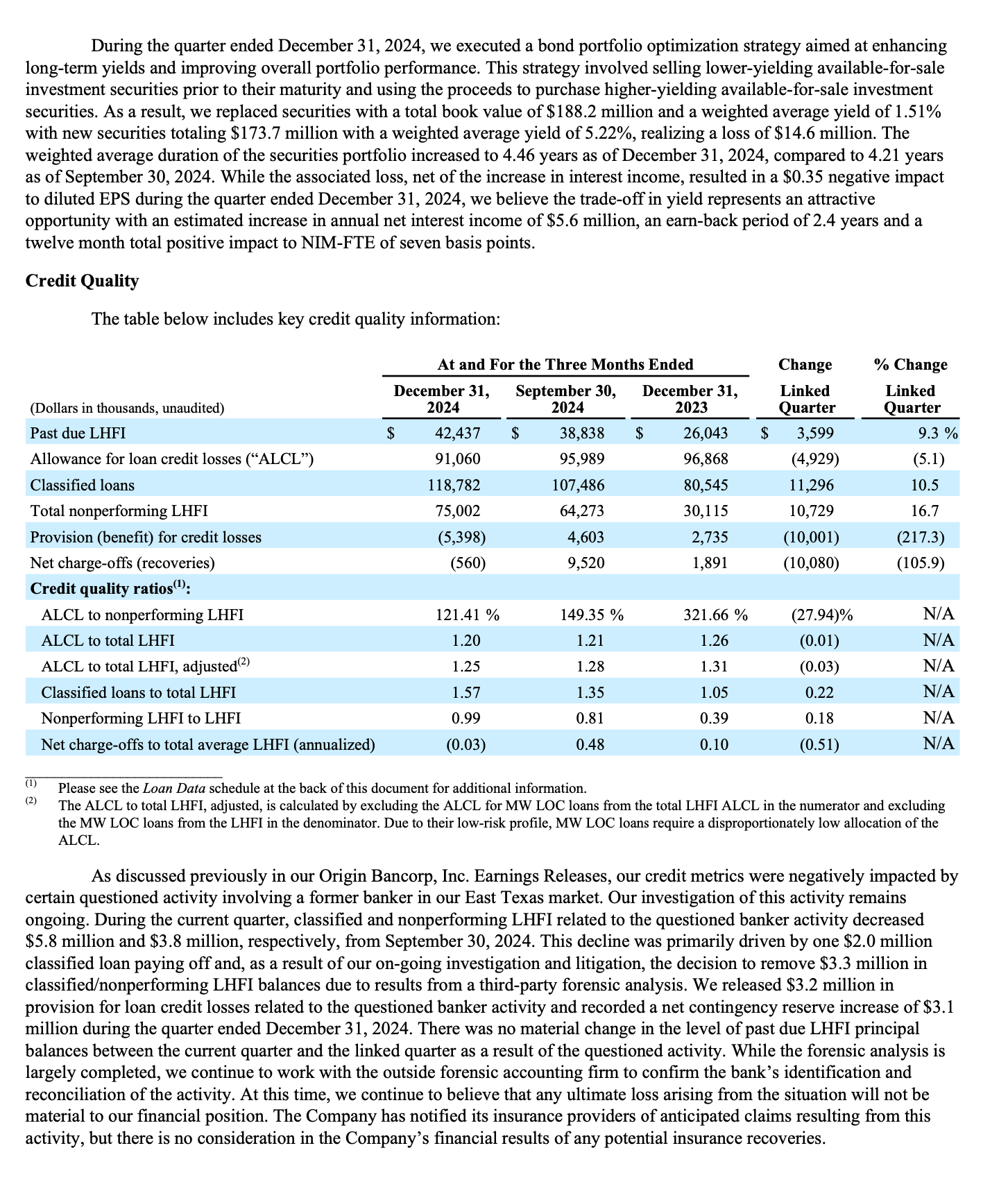

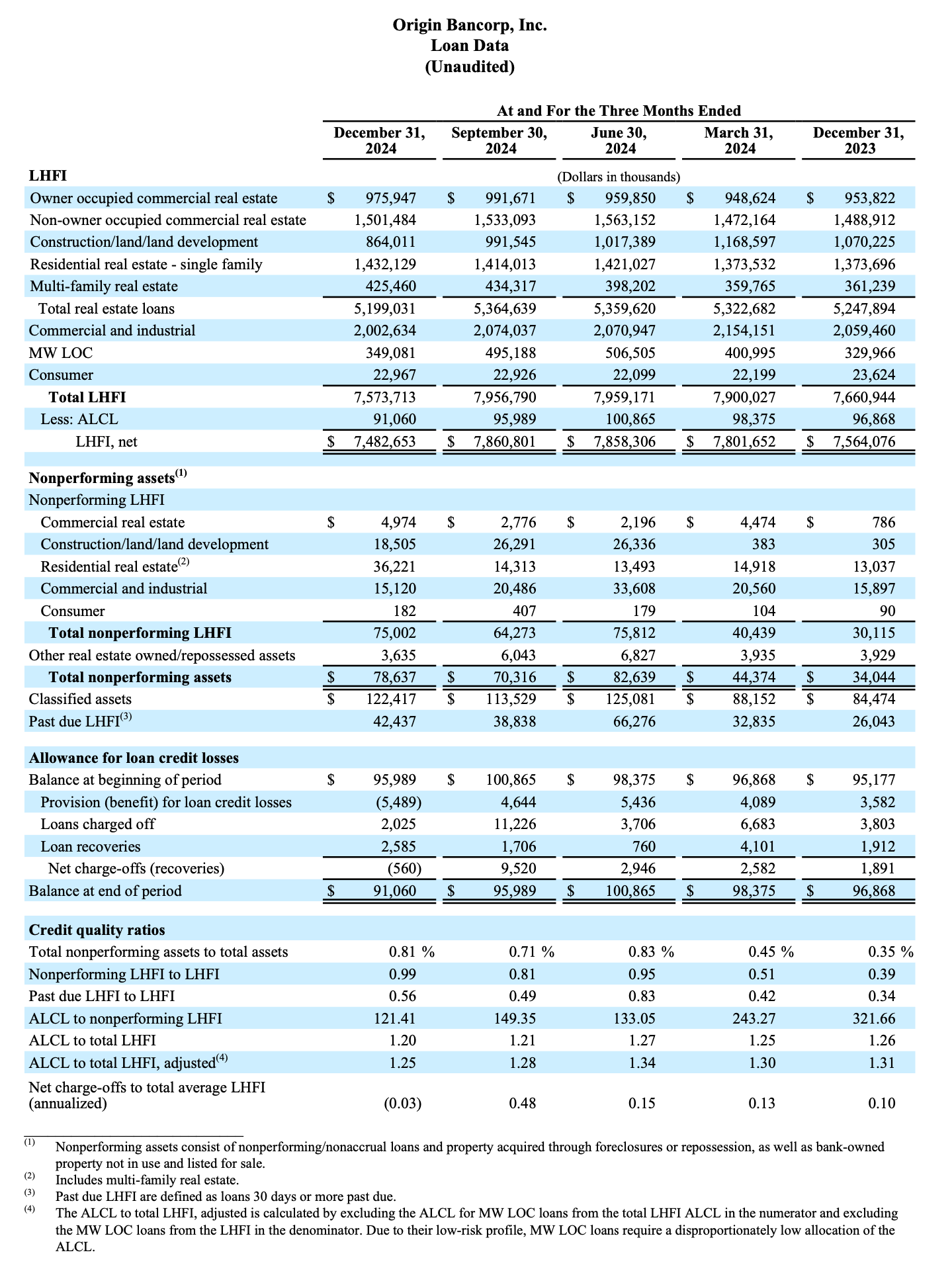

Credit Quality

The table below includes key credit quality information:

The Company recorded a credit loss provision of $6.2 million during the quarter ended March 31, 2023, compared to $4.6 million recorded during the linked quarter. The increase is primarily due to additional loan growth of $285.8 million during the current quarter.

The ALCL to nonperforming LHFI decreased to 538.8% at March 31, 2023, compared to 876.9% at December 31, 2022, driven by an increase of $7.1 million in the Company’s nonperforming LHFI, offset by an increase of $4.8 million in the ALCL for the quarter. The increase in nonperforming LHFI at March 31, 2023, compared to the linked quarter is primarily due to six loan relationships, five of which were acquired relationships. Quarterly net charge-offs increased to $1.3 million from $180,000 for the linked quarter, primarily due to a $1.9 million recovery on a commercial and industrial loan during the linked quarter, with no such recovery during the current quarter. Net charge-offs to total average LHFI (annualized) increased to 0.07% for the quarter ending March 31, 2023, compared to 0.01% for the linked quarter. Classified loans increased $12.0 million at March 31, 2023, compared to the linked quarter, and represented 1.17% of LHFI, at March 31, 2023, compared to 1.05% at December 31, 2022. The ALCL to total LHFI increased to 1.25% at March 31, 2023, compared to 1.23% at December 31, 2022.

Noninterest Income

Noninterest income for the quarter ended March 31, 2023, was $16.4 million, an increase of $3.0 million, or 22.0%, from the linked quarter. The increase from the linked quarter was primarily driven by increases of $2.0 million and $580,000 on the insurance commission and fee income and mortgage banking revenue, respectively.

The increase in insurance commission and fee income was primarily driven by the increase in annual contingency fee income recognized in the first quarter.

The increase in mortgage banking revenue was primarily due to a stronger production pipeline during the current quarter, compared to the quarter ended December 31, 2022.

Noninterest Expense

Noninterest expense for the quarter ended March 31, 2023, was $56.8 million, a decrease of $494,000 compared to the linked quarter. The decrease from the linked quarter was primarily due to a $1.2 million decrease in merger-related expense, partially offset by an increase of $640,000 in occupancy and equipment, net.

Merger-related expenses declined $1.2 million compared to the quarter ended December 31, 2022, primarily due to expenses associated with the BTH merger incurred during the linked quarter, with no merger expenses incurred during the current quarter.

Occupancy and equipment, net expense increased $640,000 during the current quarter compared to the linked quarter, primarily due to the planned addition of one new banking location and one mortgage production office during the current quarter. Additionally, higher property taxes drove an increase of $182,000 and ATM maintenance expense increased $118,000 during the current quarter compared to the linked quarter.

Income Taxes

The effective tax rate was 20.5% during the quarter ended March 31, 2023, compared to 18.8% during the linked quarter and 20.4% during the quarter ended March 31, 2022. The effective tax rate for the current quarter was higher due to increased state tax compared to the linked quarter.

Financial Condition

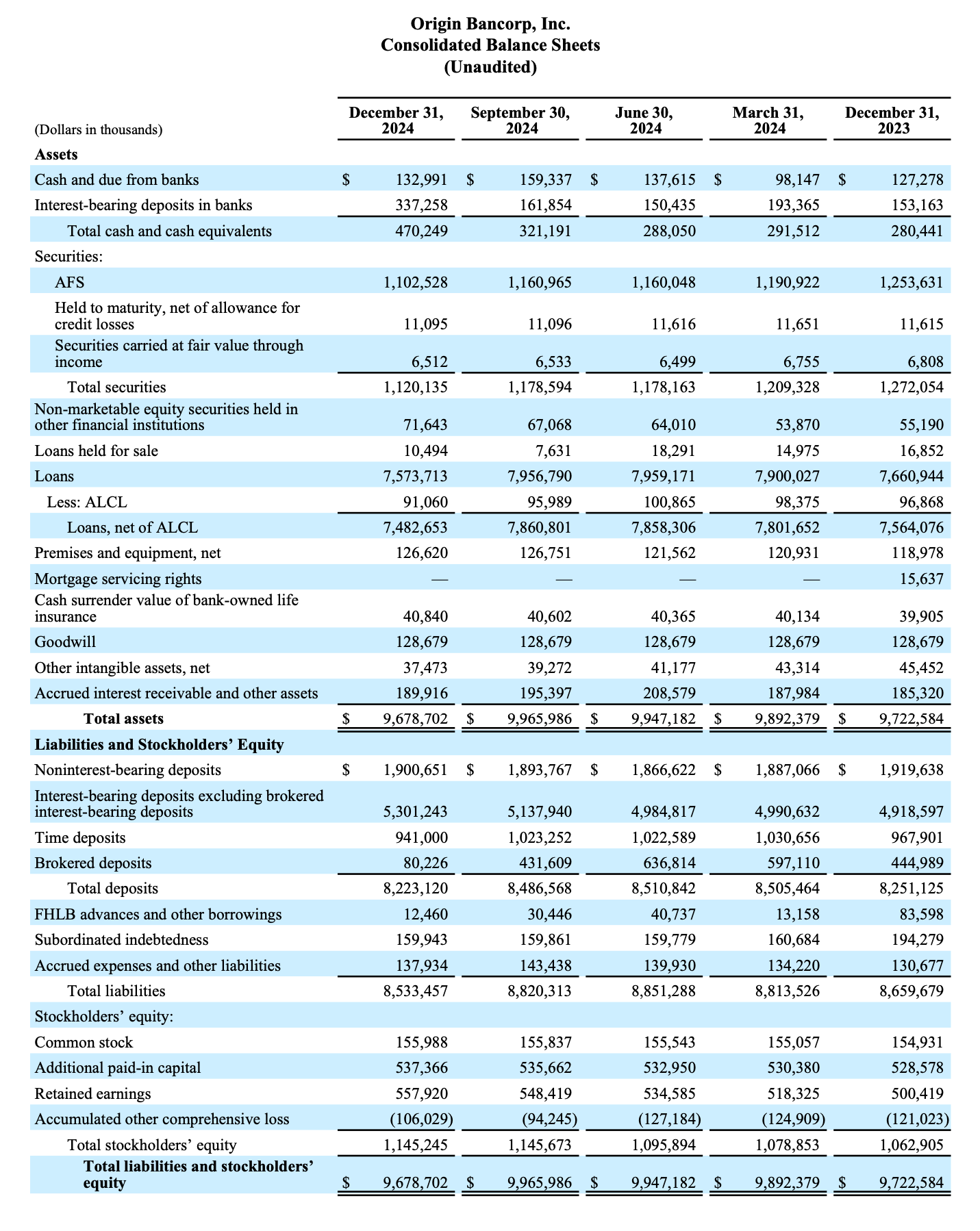

Total Assets

• Total assets exceeded $10.00 billion at March 31, 2023, primarily due to the additional temporary cash added in March 2023, as noted above.

Loans

• Total LHFI at March 31, 2023, were $7.38 billion, an increase of $285.8 million, or 4.0%, from $7.09 billion at December 31, 2022, and an increase of $2.18 billion, or 42.0%, compared to March 31, 2022.

• Total real estate loans were $4.92 billion at March 31, 2023, an increase of $194.7 million, or 4.1%, from the linked quarter, with residential real estate loan growth contributing $111.0 million of the total real estate loan growth.

• Mortgage warehouse lines of credit totaled $337.5 million at March 31, 2023, an increase of $52.7 million, or 18.5%, compared to the linked quarter.

• All loan categories experienced increases in loan balances during the current quarter compared to the linked quarter with the exception of consumer loans.

Securities

• Total securities at March 31, 2023, were $1.61 billion, a decrease of $50.2 million, or 3.0%, compared to the linked quarter and a decrease of $308.6 million, or 16.1%, compared to March 31, 2022.

• The decrease was due to sales, maturities, scheduled principal payments, and calls. Securities of $38.7 million primarily municipal securities, were sold during the current quarter and the Company realized a net gain of $144,000 on the sale.

• Accumulated other comprehensive loss, net of taxes, primarily associated with the AFS portfolio, was $138.5 million at March 31, 2023, an improvement of $21.4 million during the current quarter.

• The weighted average effective duration for the total securities portfolio was 4.17 years as of March 31, 2023, compared to 4.24 years as of December 31, 2022.

Deposits

• Total deposits at March 31, 2023, were $8.17 billion, an increase of $398.6 million, or 5.1%, compared to the linked quarter, and represented an increase of $1.41 billion, or 20.8%, from March 31, 2022.

• The increase in the current quarter compared to the linked quarter was primarily due to increases of $283.8 million and $228.4 million in brokered deposits and money market deposits, respectively, which was partially offset by a $234.7 million decrease in noninterest-bearing deposits. During the month of February 2023, we added $275.0 million of brokered deposits as a less expensive alternative to FHLB advances.

• For the quarter ended March 31, 2023, average noninterest-bearing deposits as a percentage of total average deposits were 29.8%, compared to 33.6% and 33.0% for the quarter ended December 31, 2022, and March 31, 2022, respectively.

• Uninsured/uncollateralized deposits totaled $3.09 billion at March 31, 2023, compared to $3.43 billion at December 31, 2022, representing 37.8% and 44.1% of total deposits at March 31, 2023 and December 31, 2022, respectively.

Borrowings

• FHLB advances and other borrowings at March 31, 2023, were $875.5 million, an increase of $236.3 million, or 37.0%, compared to the linked quarter and represented an increase of $569.9 million, or 186.5%, from March 31, 2022. The increase was due to a strategic decision in early March 2023 to borrow $700.0 million and hold excess cash for contingency liquidity.

• Average FHLB advances were $432.2 million for the quarter ended March 31, 2023, a decrease of $79.7 million from $511.9 million for the quarter ended December 31, 2022 and an increase of $255.0 million from March 31, 2022.

Stockholders’ Equity

• Stockholders’ equity was $992.6 million at March 31, 2023, an increase of $42.6 million, or 4.5%, compared to $949.9 million at December 31, 2022, and an increase of $315.7 million, or 46.6%, compared to $676.9 million, at March 31, 2022.

• The increase in stockholders’ equity from the linked quarter is primarily due to net income of $24.3 million and a decrease in accumulated other comprehensive loss, net of tax, of $21.4 million during the current quarter.

• The increase from March 31, 2022, is primarily associated with the BTH merger, which drove a $306.3 million increase in stockholders' equity and net income retained during the intervening period. The increase was partially offset by other comprehensive loss, net of tax and dividends declared during the year.

Conference Call

Origin will hold a conference call to discuss its first quarter 2023 results on Thursday, April 27, 2023, at 8:00 a.m. Central Time (9:00 a.m. Eastern Time). To participate in the live conference call, please dial +1 (929) 272-1574 (U.S. Local / International); +1 (800) 528-1066 (U.S. Toll Free), enter Conference ID: 15370 and request to be joined into the Origin Bancorp, Inc. (OBNK) call. A simultaneous audio-only webcast may be accessed via Origin’s website at www.origin.bank under the investor relations, News & Events, Events & Presentations link or directly by visiting https://dealroadshow.com/e/ ORIGINQ123.

If you are unable to participate during the live webcast, the webcast will be archived on the Investor Relations section of Origin’s website at www.origin.bank, under Investor Relations, News & Events, Events & Presentations.

About Origin

Origin Bancorp, Inc. is a financial holding company headquartered in Ruston, Louisiana. Origin’s wholly owned bank subsidiary, Origin Bank, was founded in 1912 in Choudrant, Louisiana. Deeply rooted in Origin’s history is a culture committed to providing personalized, relationship banking to businesses, municipalities, and personal clients to enrich the lives of the people in the communities it serves. Origin provides a broad range of financial services and currently operates 60 banking centers located in Dallas/Fort Worth, East Texas, Houston, North Louisiana and Mississippi. For more information, visit www.origin.bank.

Non-GAAP Financial Measures

Origin reports its results in accordance with accounting principles generally accepted in the United States of America ("GAAP"). However, management believes that certain supplemental non-GAAP financial measures may provide meaningful information to investors that is useful in understanding Origin's results of operations and underlying trends in its business. However, non-GAAP financial measures are supplemental and should be viewed in addition to, and not as an alternative for, Origin's reported results prepared in accordance with GAAP. The following are the non-GAAP measures used in this release: adjusted net income, adjusted PTPP earnings, adjusted diluted EPS, NIM-FTE, adjusted, adjusted ROAA, adjusted PTPP ROAA, adjusted ROAE, adjusted PTPP ROAE, tangible book value per common share, adjusted tangible book value per common share, tangible common equity to tangible assets, ROATCE and adjusted ROATCE and adjusted efficiency ratio.

Please see the last few pages of this release for reconciliations of non-GAAP measures to the most directly comparable financial measures calculated in accordance with GAAP.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information regarding Origin’s future financial performance, business and growth strategy, projected plans and objectives, and any expected purchases of its outstanding common stock, and related transactions and other projections based on macroeconomic and industry trends, including changes to interest rates by the Federal Reserve and the resulting impact on Origin’s results of operations, estimated forbearance amounts and expectations regarding the Company’s liquidity, including in connection with advances obtained from the FHLB, which are all subject to change and may be inherently unreliable due to the multiple factors that impact broader economic and industry trends, and any such changes may be material. Such forward-looking statements are based on various facts and derived utilizing important assumptions and current expectations, estimates and projections about Origin and its subsidiaries, any of which may change over time and some of which may be beyond Origin’s control. Statements or statistics preceded by, followed by or that otherwise include the words “assumes,” “anticipates,” “believes,” “estimates,” “expects,” “foresees,” “intends,” “plans,” “projects,” and similar expressions or future or conditional verbs such as “could,” “may,” “might,” “should,” “will,” and “would” and variations of such terms are generally forward-looking in nature and not historical facts, although not all forward- looking statements include the foregoing words. Further, certain factors that could affect Origin’s future results and cause actual results to differ materially from those expressed in the forward-looking statements include, but are not limited to: potential impacts of the recent adverse developments in the banking industry highlighted by high-profile bank failures, including impacts on customer confidence, deposit outflows, liquidity and the regulatory response thereto, the impact of current and future economic conditions generally and in the financial services industry, nationally and within Origin’s primary market areas, including the effects of declines in the real estate market, high unemployment rates, inflationary pressures, elevated interest rates and slowdowns in economic growth, as well as the financial stress on borrowers and changes to customer and client behavior as a result of the foregoing, deterioration of Origin’s asset quality; factors that can impact the performance of Origin’s loan portfolio, including real estate values and liquidity in Origin’s primary market areas; the financial health of Origin’s commercial borrowers and the success of construction projects that Origin finances; changes in the value of collateral securing Origin’s loans; developments in our mortgage banking business, including loan modifications, general demand, and the effects of judicial or regulatory requirements or guidance; Origin’s ability to anticipate interest rate changes and manage interest rate risk, (including the impact of higher interest rates on macroeconomic conditions, competition, and the cost of doing business); the effectiveness of Origin’s risk management framework and quantitative models; Origin’s inability to receive dividends from Origin Bank and to service debt, pay dividends to Origin’s common stockholders, repurchase Origin’s shares of common stock and satisfy obligations as they become due; the impact of labor pressures; changes in Origin’s operation or expansion strategy or Origin’s ability to prudently manage its growth and execute its strategy; changes in management personnel; Origin’s ability to maintain important customer relationships, reputation or otherwise avoid liquidity risks; increasing costs as Origin grows deposits; operational risks associated with Origin’s business; volatility and direction of market interest rates; significant turbulence or a disruption in the capital or financial markets and the effect of a fall in stock market prices on our investment securities; increased competition in the financial services industry, particularly from regional and national institutions, as well as from fintech companies; difficult market conditions and unfavorable economic trends in the United States generally, and particularly in the market areas in which Origin operates and in which its loans are concentrated; an increase in unemployment levels and slowdowns in economic growth; Origin’s level of nonperforming assets and the costs associated with resolving any problem loans including litigation and other costs; the credit risk associated with the substantial amount of commercial real estate, construction and land development, and commercial loans in Origin’s loan portfolio; changes in laws, rules, regulations, interpretations or policies relating to financial institutions, and potential expenses associated with complying with such regulations; periodic changes to the extensive body of accounting rules and best practices; further government intervention in the U.S. financial system; a deterioration of the credit rating for U.S. long-term sovereign debt, actions that the U.S. government may take to avoid exceeding the debt ceiling, or uncertainties surrounding the debt ceiling and the federal budget; compliance with governmental and regulatory requirements, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and others relating to banking, consumer protection, securities, and tax matters; Origin’s ability to comply with applicable capital and liquidity requirements, including its ability to generate liquidity internally or raise capital on favorable terms, including continued access to the debt and equity capital markets; changes in the utility of Origin’s non-GAAP liquidity measurements and its underlying assumptions or estimates; uncertainty regarding the transition away from the London Interbank Offered Rate and the impact of any replacement alternatives such as the Secured Overnight Financing Rate on Origin’s business; possible changes in trade, monetary and fiscal policies, laws and regulations and other activities of governments, agencies and similar organizations; natural disasters and adverse weather events, acts of terrorism, an outbreak of hostilities (including the impacts related to or resulting from Russia's military action in Ukraine, including the imposition of additional sanctions and export controls, as well as the broader impacts to financial markets and the global macroeconomic and geopolitical environments), regional or national protests and civil unrest (including any resulting branch closures or property damage), widespread illness or public health outbreaks or other international or domestic calamities, and other matters beyond Origin’s control; and system failures, cybersecurity threats or security breaches and the cost of defending against them. For a discussion of these and other risks that may cause actual results to differ from expectations, please refer to the sections titled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Origin’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission and any updates to those sections set forth in Origin’s subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Origin’s underlying assumptions prove to be incorrect, actual results may differ materially from what Origin anticipates. Accordingly, you should not place undue reliance on any forward-looking statements. Any forward- looking statement speaks only as of the date on which it is made, and Origin does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

New risks and uncertainties arise from time to time, and it is not possible for Origin to predict those events or how they may affect Origin. In addition, Origin cannot assess the impact of each factor on Origin’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Origin or persons acting on Origin’s behalf may issue. Annualized, pro forma, adjusted, projected, and estimated numbers are used for illustrative purposes only, are not forecasts, and may not reflect actual results.

Contact:

Investor Relations

Chris Reigelman 318-497-3177 chris@origin.bank

Media Contact

Ryan Kilpatrick 318-232-7472 rkilpatrick@origin.bank