Latest News

Origin Bancorp, Inc. Reports Earnings for Fourth Quarter and 2022 Full Year

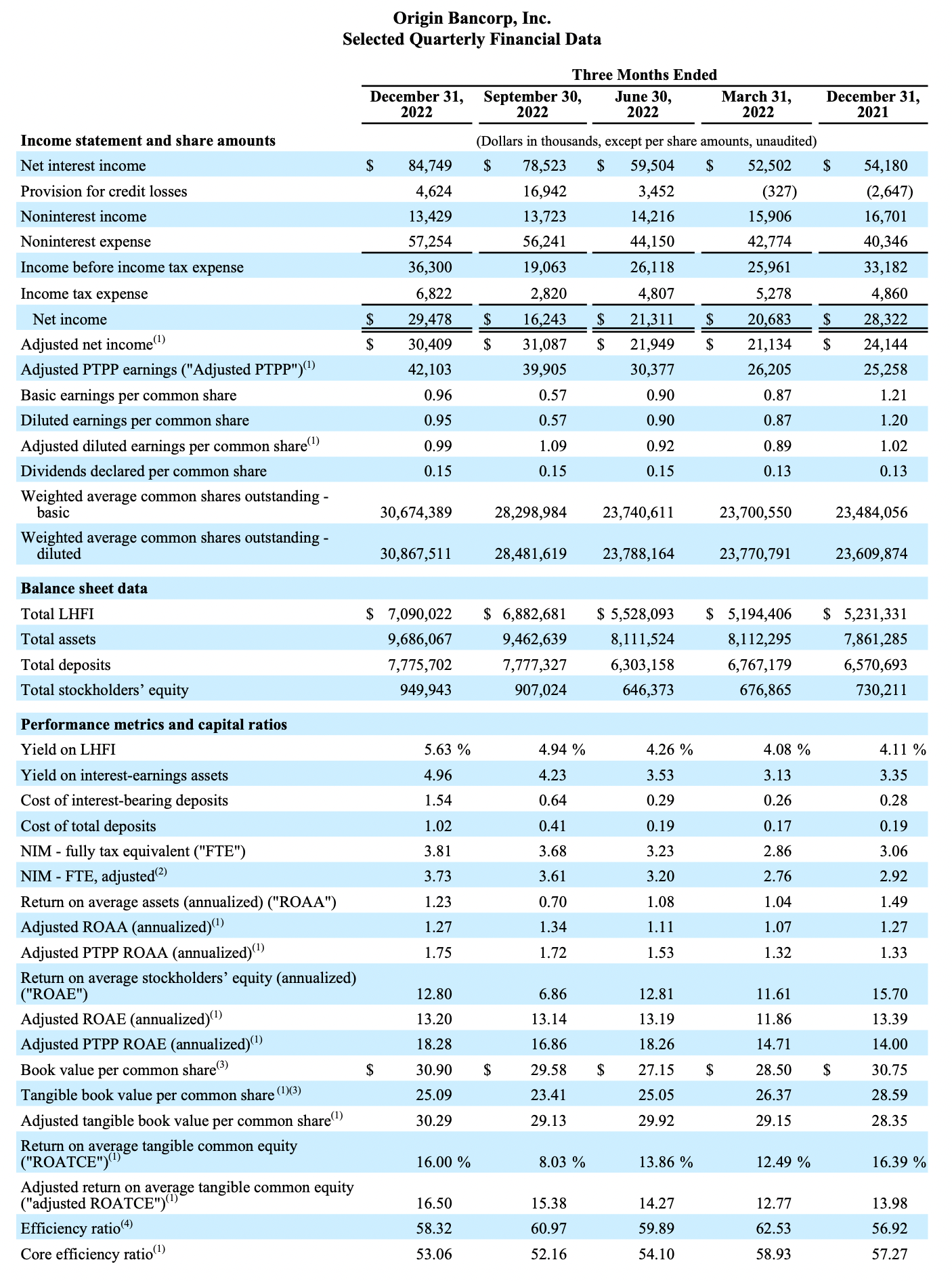

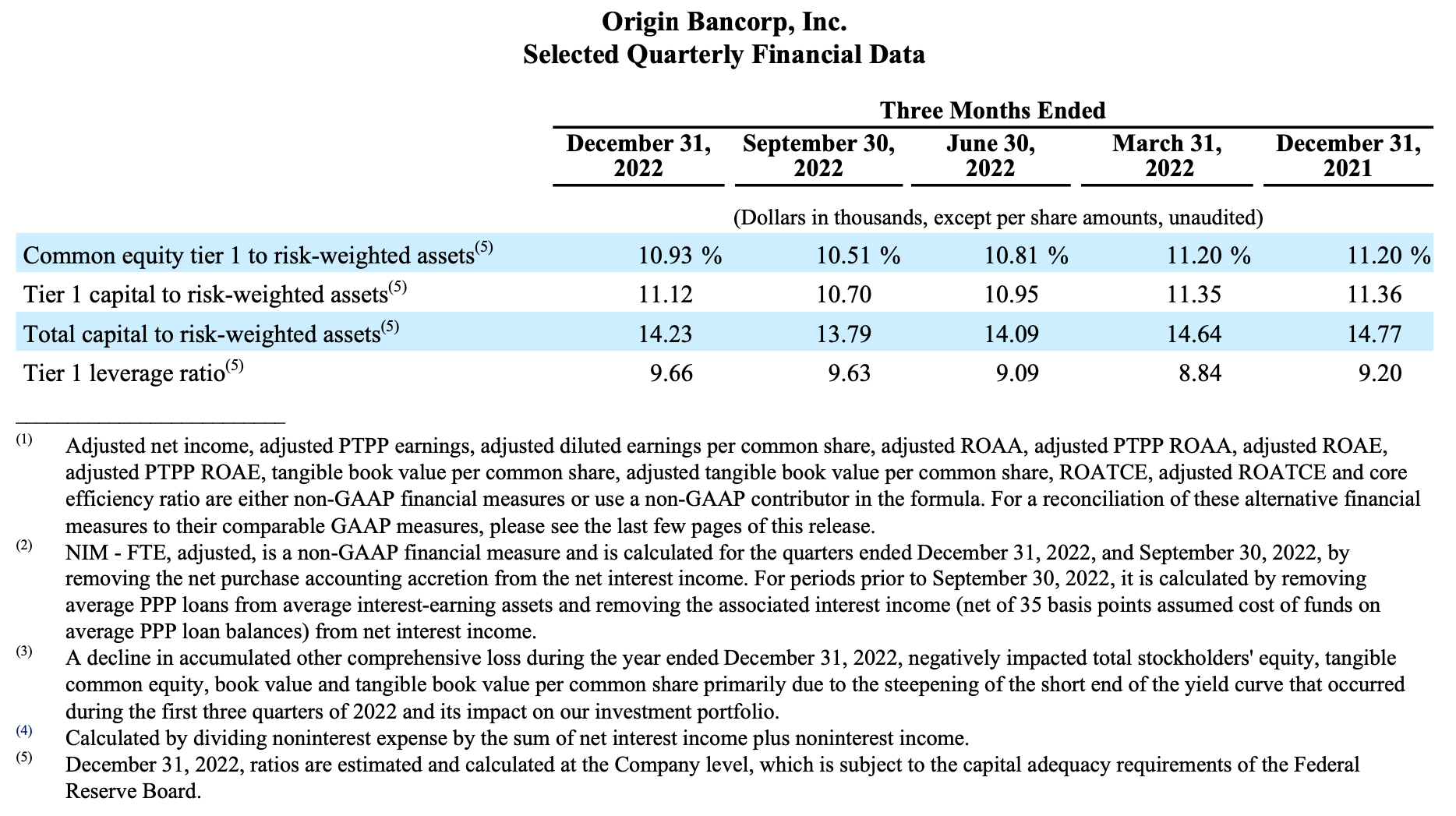

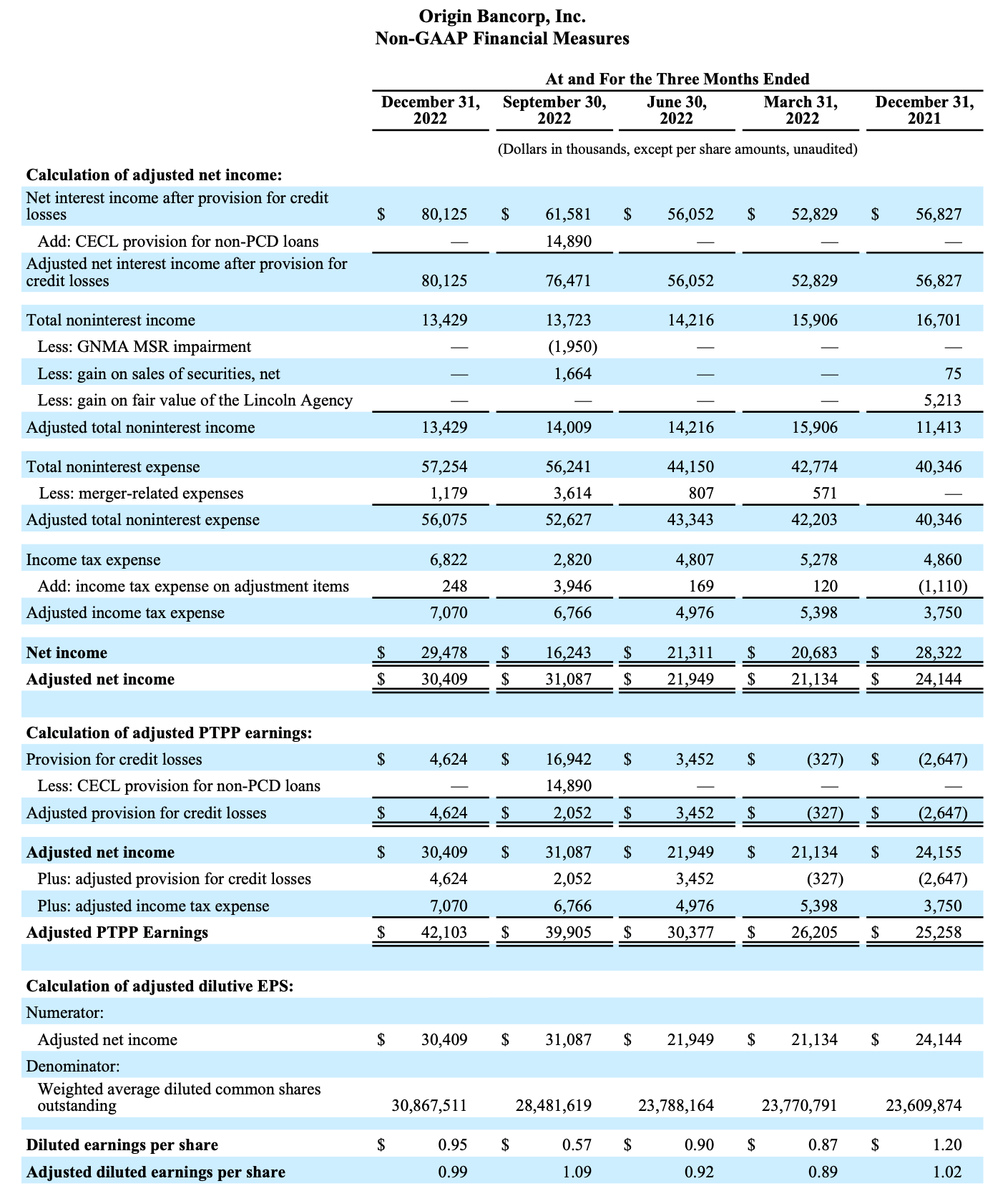

Origin Bancorp, Inc. (Nasdaq: OBNK) (“Origin” or the “Company”), the holding company for Origin Bank (the “Bank”), today announced net income of $29.5 million, or $0.95 diluted earnings per share for the quarter ended December 31, 2022, compared to net income of $16.2 million, or $0.57 diluted earnings per share, for the quarter ended September 30, 2022, and compared to net income of $28.3 million, or $1.20 diluted earnings per share for the quarter ended December 31, 2021. Adjusted net income(1) for the quarter ended December 31, 2022, was $30.4 million, or $0.99 adjusted diluted earnings per share(1). Adjusted pre-tax, pre-provision ("adjusted PTPP")(1) earnings was $42.1 million.

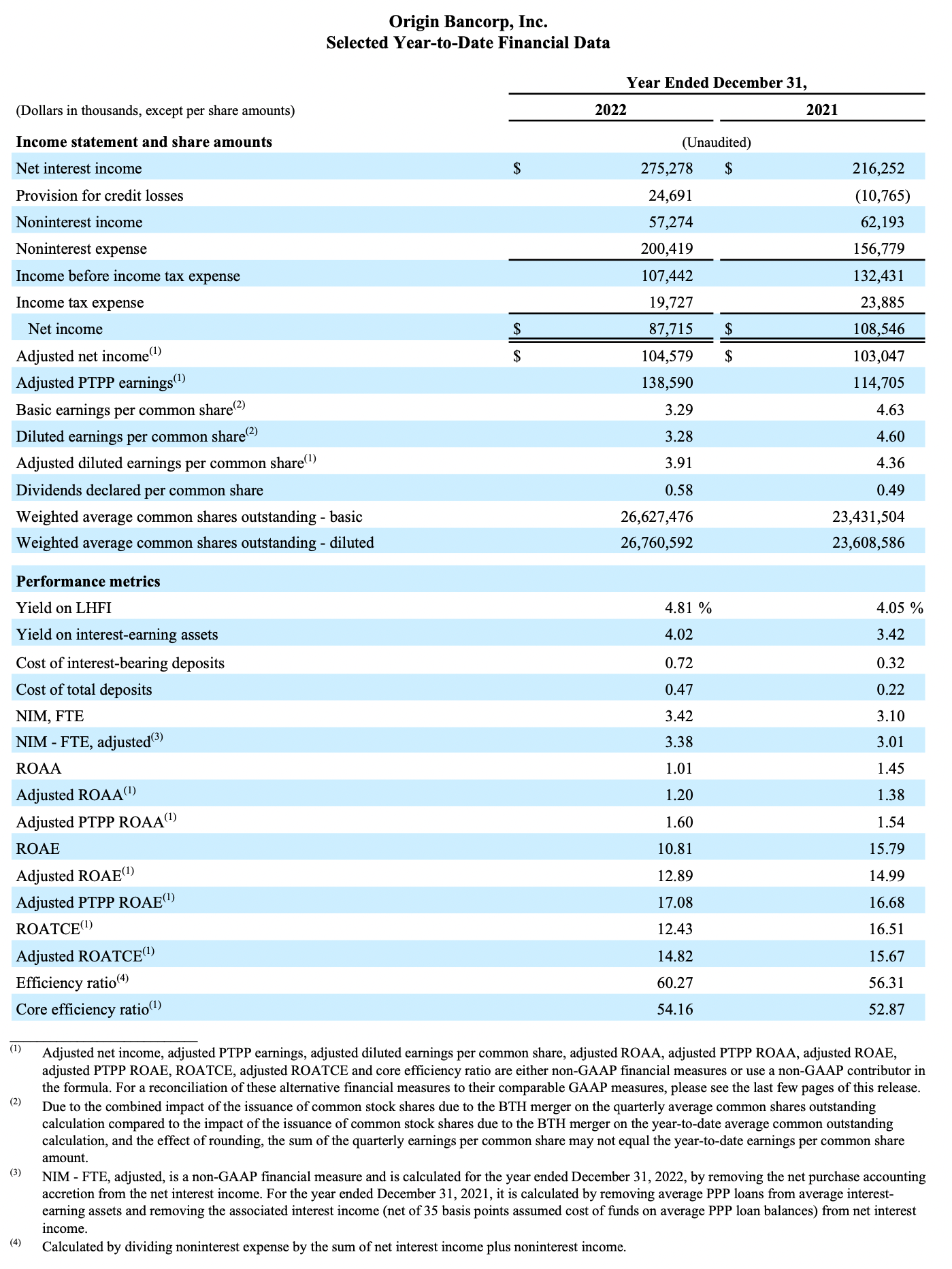

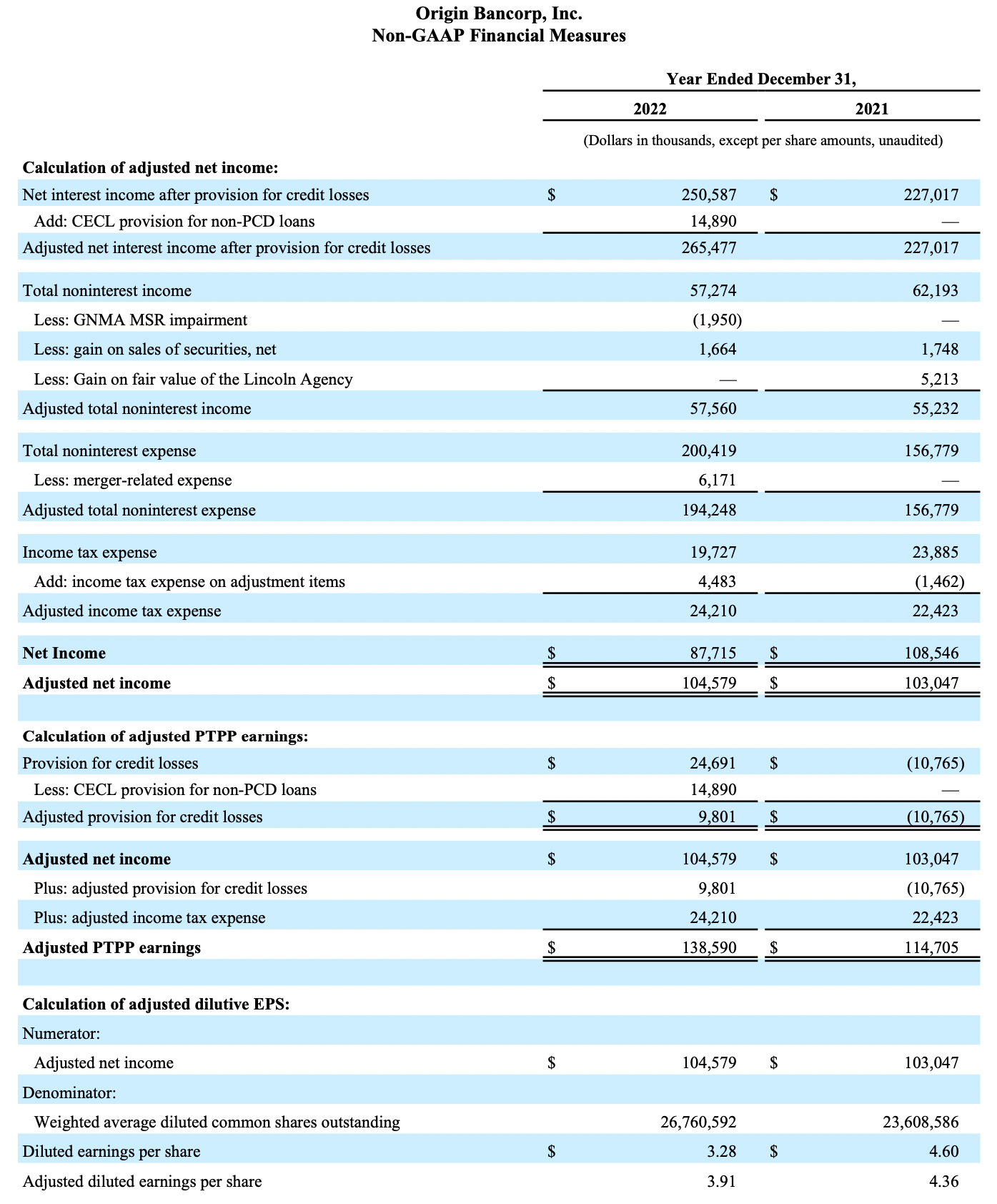

Net income for the year ended December 31, 2022, was $87.7 million, reflecting diluted earnings per share for the year ended December 31, 2022, of $3.28 representing a decrease of $1.32, or 28.7%, from diluted earnings per share of $4.60 for the year ended December 31, 2021.

“As I look back on the past quarter and 2022 as a whole, I’m very pleased with where we are as a company and how we are operating from a position of strength,” said Drake Mills, chairman, president, and CEO of Origin Bancorp, Inc. “We showed positive financial results for the quarter and the year, bolstered our Texas franchise with the partnership with BTH, attracted high-quality bankers across our footprint, and significantly grew our loan portfolio while maintaining our conservative credit culture.”

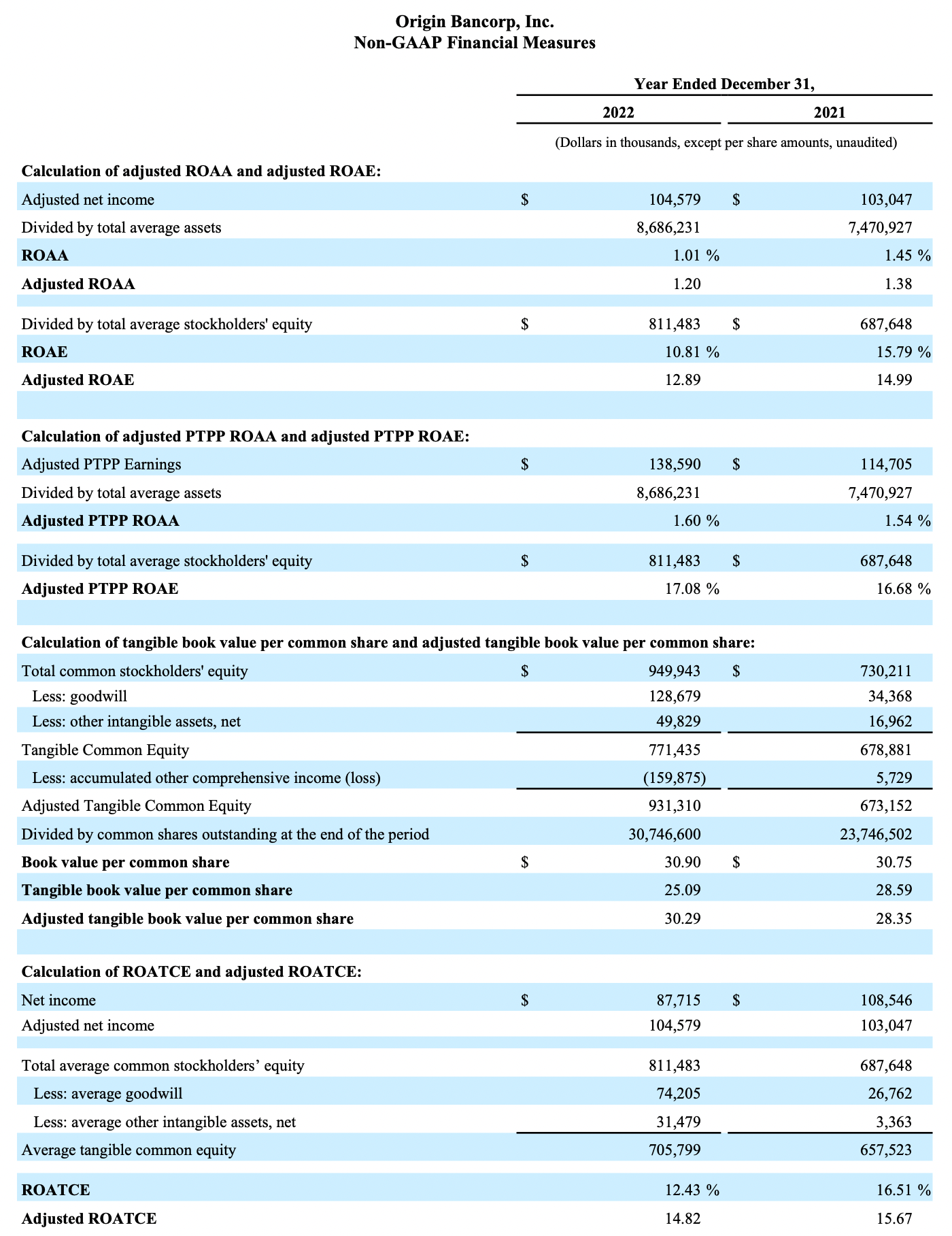

(1) Adjusted net income, adjusted diluted earnings per share and adjusted PTPP earnings are non-GAAP financial measures, please see the last few pages of this document for a reconciliation of these alternative financial measures to their comparable GAAP measures.

Financial Highlights

• The fully tax-equivalent net interest margin (“NIM”) was 3.81% for the quarter ended December 31, 2022, reflecting a 13 basis point increase from the linked quarter and a 75 basis point increase from the quarter ended December 31, 2021. The fully tax-equivalent NIM, adjusted(1), which excludes the net purchase accounting accretion from the net interest income for the quarter ended December 31, 2022, was 3.73%, reflecting a 12 basis point increase from the linked quarter.

• Net interest income for the quarter ended December 31, 2022, was $84.7 million, reflecting a $6.2 million, or 7.9% increase, compared to the linked quarter, and a $30.6 million, or 56.4% increase, compared to the prior year quarter.

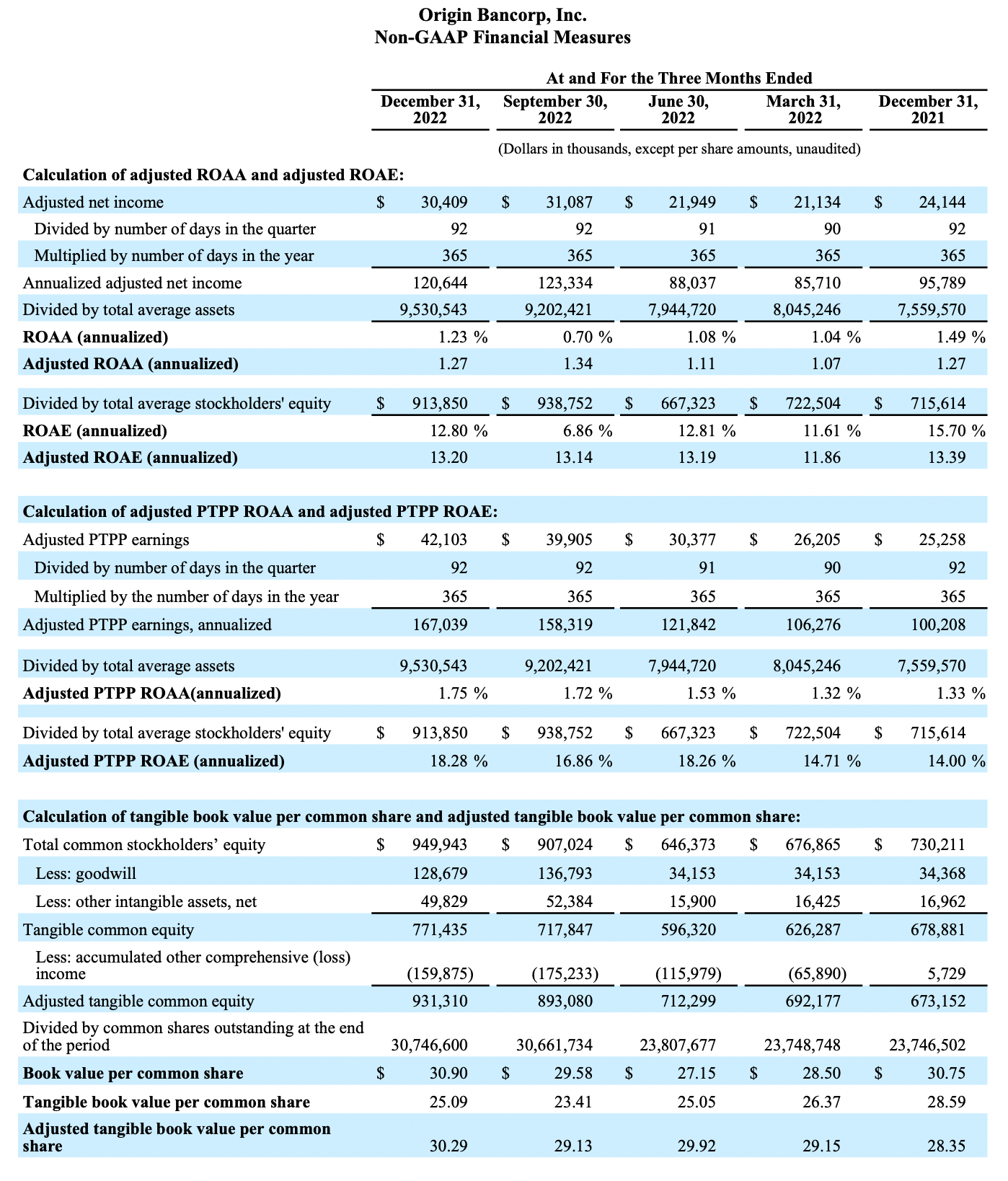

• The Company's annualized returns on average assets and average equity were 1.23% and 12.80%, respectively, for the quarter ended December 31, 2022, compared to 0.70% and 6.86%, respectively, for the linked quarter.

• Excluding mortgage warehouse lines of credit, total LHFI were $6.81 billion, reflecting an increase of $383.0 million, or 6.0%, compared to September 30, 2022.

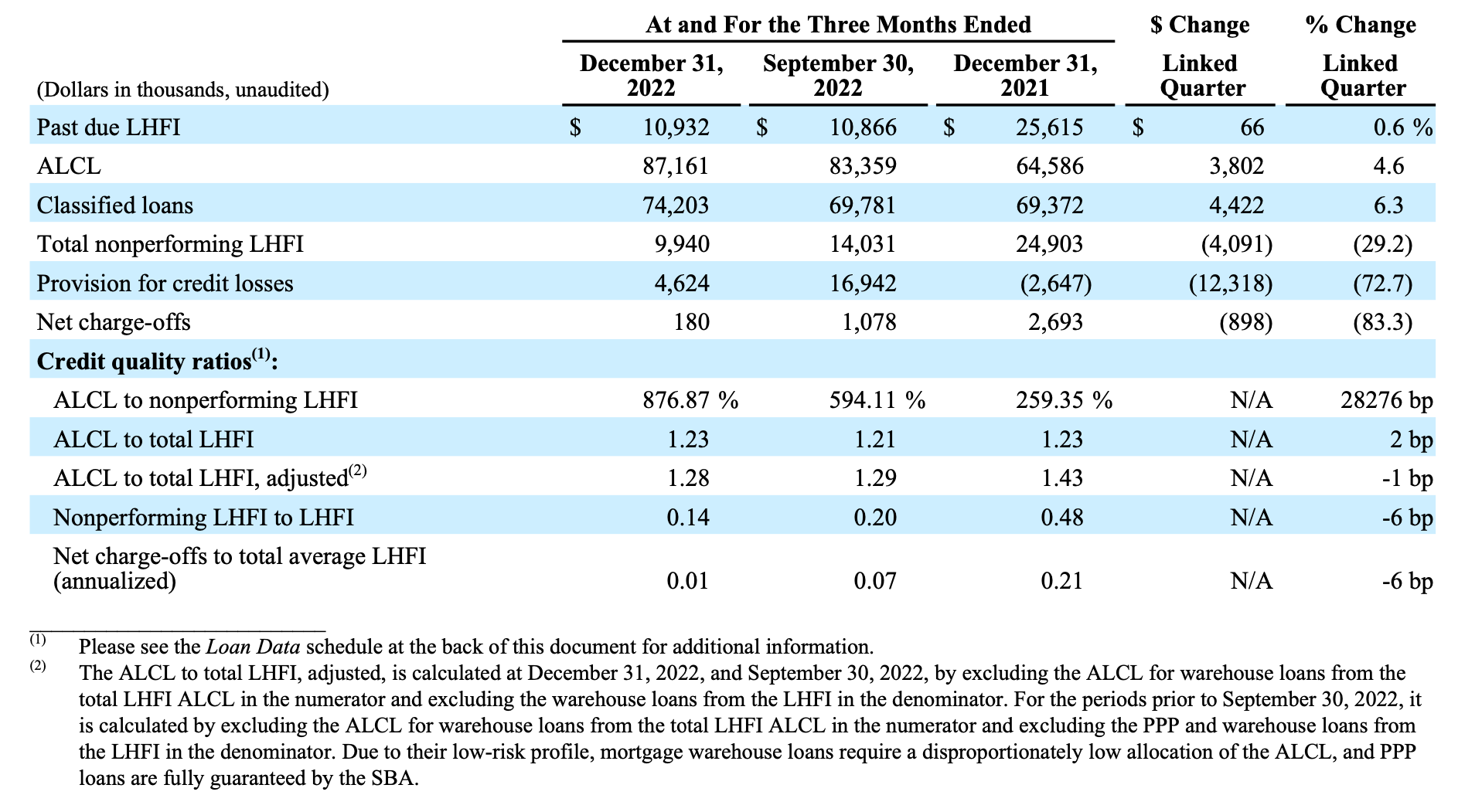

• Provision for credit losses was a net expense of $4.6 million for the quarter ended December 31, 2022, compared to a net expense of $16.9 million for the linked quarter. The decrease was primarily due to the merger with BTH, which required a Day 1 Current Expected Credit Loss ("CECL") loan provision of $14.9 million during the linked quarter.

• The allowance for loan credit losses ("ALCL") to total LHFI, adjusted (2) was 1.28% at December 31, 2022, compared to 1.29% at September 30, 2022.

• Total nonperforming LHFI to total LHFI was 0.14% at December 31, 2022, compared to 0.20% at September 30, 2022, and 0.48% at December 31, 2021. The ALCL to nonperforming LHFI was 876.87% at December 31, 2022, compared to 594.11% and 259.35% at the linked quarter and prior year quarter ends, respectively.

(1) Fully tax equivalent NIM, adjusted, is a non-GAAP financial measure and is calculated by removing the net purchase accounting accretion from the net interest income.

(2) The ALCL to total LHFI, adjusted, is calculated at December 31, 2022, and September 30, 2022, by excluding the ALCL for warehouse loans from the total LHFI ALCL in the numerator and excluding the warehouse loans from the LHFI in the denominator. For the periods prior to September 30, 2022, it is calculated by excluding the ALCL for warehouse loans from the total LHFI ALCL in the numerator and excluding the Payroll Protection Program ("PPP") and warehouse loans from the LHFI in the denominator. Due to their low-risk profile, mortgage warehouse loans require a disproportionately low allocation of the ALCL, and PPP loans are fully guaranteed by the Small Business Administration ("SBA").

Results of Operations for the Three Months Ended December 31, 2022

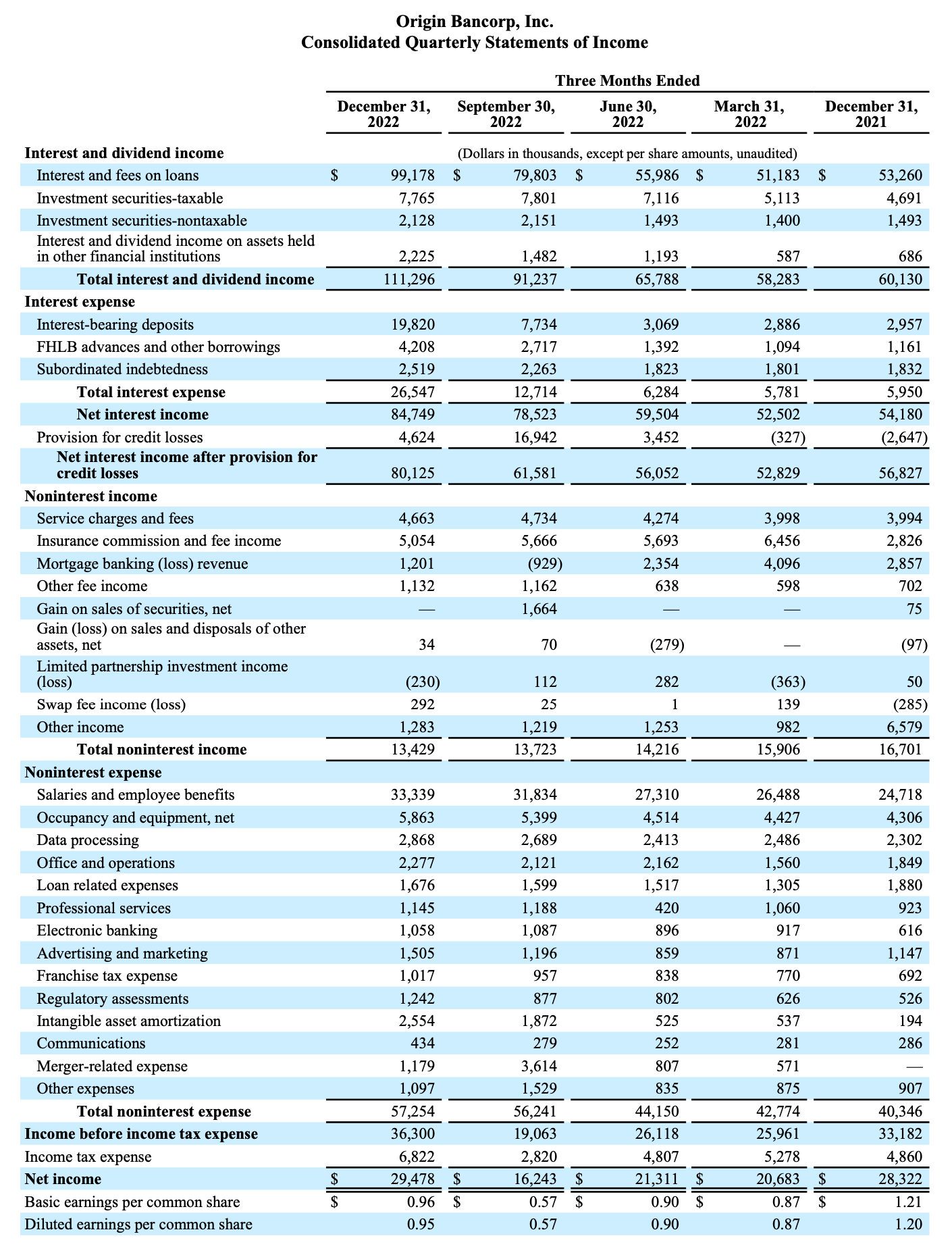

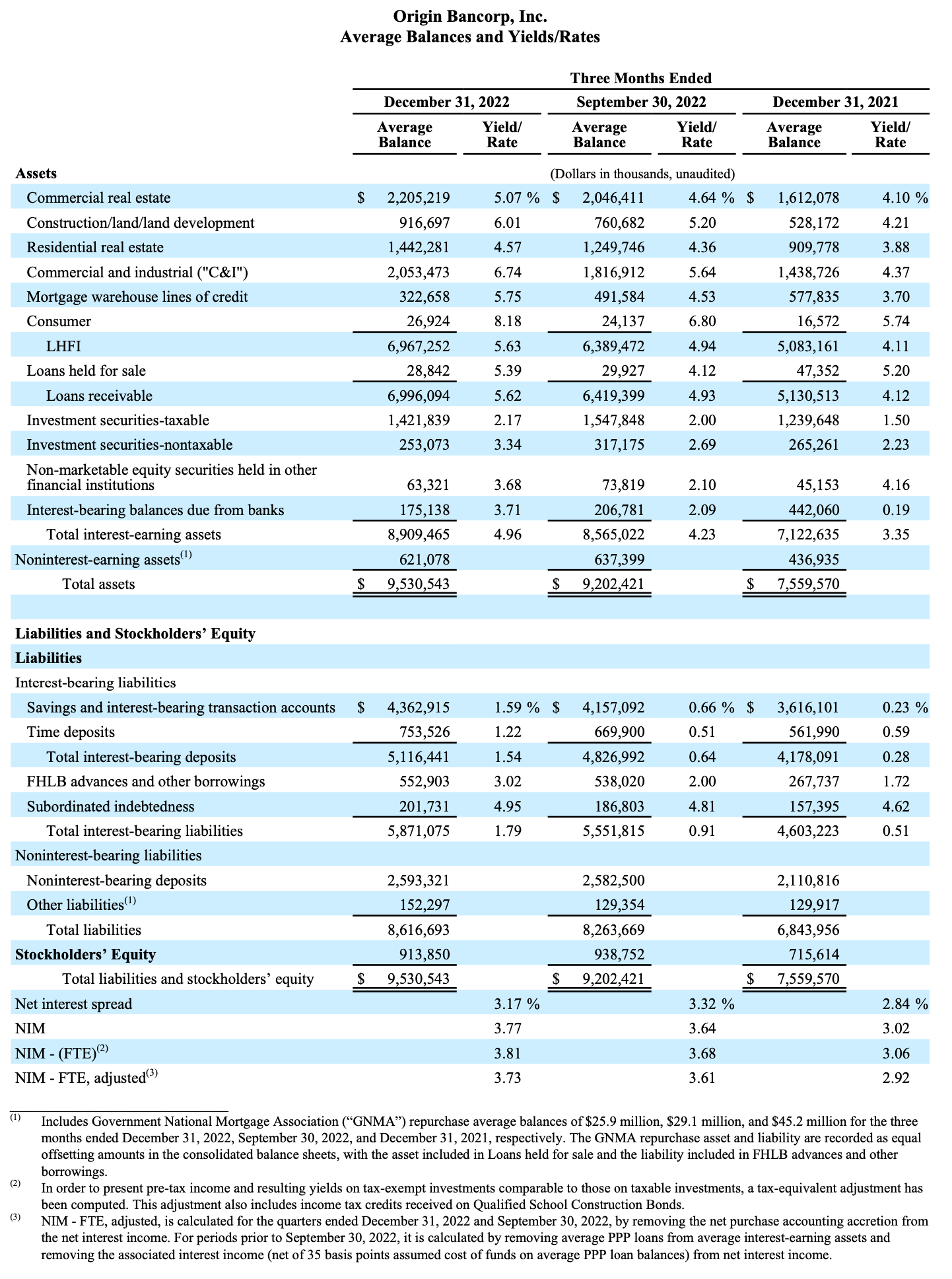

Net Interest Income and Net Interest Margin

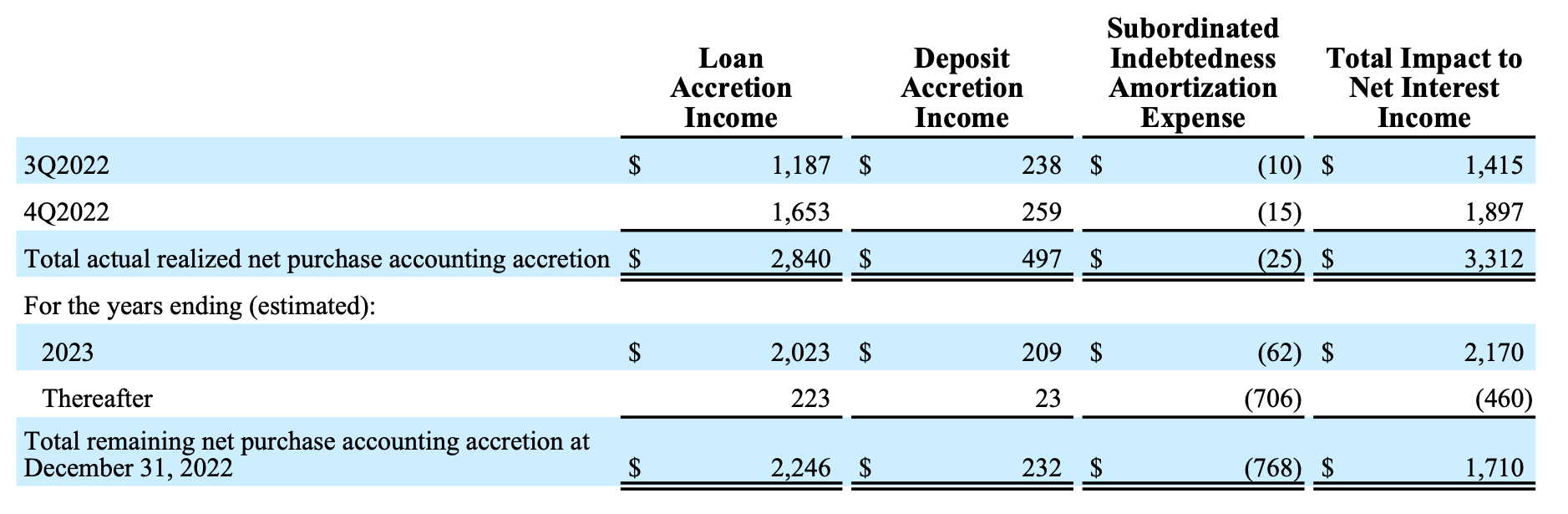

Net interest income for the quarter ended December 31, 2022, was $84.7 million, an increase of $6.2 million, or 7.9%, compared to the linked quarter. Purchase accounting accretion income on acquired loans was $1.7 million during the current quarter compared to $1.2 million during the linked quarter, with remaining purchase accounting net loan discounts totaling $2.2 million at December 31, 2022. Net purchase accounting accretion income on deposits and subordinated indebtedness totaled $244,000, bringing the total impact from purchase accounting treatment on net interest income to $1.9 million for the three months ended December 31, 2022, compared to $1.4 million for the linked quarter.

Excluding the net purchase accounting accretion, the $5.7 million increase in net interest income was mainly due to increases of $13.6 million and $6.0 million in interest income driven by an increase in market interest rates on interest-earning assets and increases in average interest-earning asset balances, respectively, during the current quarter. These increases were partially offset by a $13.1 million increase in interest expense due primarily to increased market interest rates paid on interest- bearing liabilities.

The table below presents the estimated loan and deposit accretion and subordinated indebtedness amortization schedule resulting from merger purchase accounting adjustments for the periods shown.

The increase in net interest income for the three-month period ended December 31, 2022, was the result of a $20.1 million increase in total interest income, partially offset by a $13.8 million increase in interest expense. Increases in interest rates drove a $13.9 million increase in total interest income, while increases in average interest-earning asset balances drove a $6.2 million increase in total interest income. The increase in interest expense was primarily due to rate increases, which drove an $11.6 million increase in interest expense on deposits and a $1.4 million increase in interest expense on FHLB advances and other borrowings.

The Federal Reserve Board sets various benchmark rates, including the Federal Funds rate, and thereby influences the general market rates of interest, including the loan and deposit rates offered by financial institutions. In early 2020, the Federal Reserve lowered the target rate range to 0.00% to 0.25%. These rates remained in effect throughout all of 2021. On March 17, 2022, the target rate range was increased to 0.25% to 0.50%, then subsequently increased six more times during 2022, with the most recent and current Federal Funds target rate range being set at December 14, 2022, to 4.25% to 4.50%. At December 31, 2022, the Federal Funds target rate range had increased 425 basis points on a year-to-date basis. In order to remain competitive as market interest rates increase, interest rates paid on deposits must also increase. Increases in interest rates contributed $11.8 million to the total increase in interest income earned on total LHFI, while interest rates increased our total deposit interest expense by $11.6 million during the current quarter compared to the linked quarter.

The yield on LHFI was 5.63% and 4.94% for the three months ended December 31, 2022, and September 30, 2022, respectively, and average LHFI balances increased to $6.97 billion for the quarter ended December 31, 2022, compared to $6.39 billion for the linked quarter. The yield on LHFI, excluding the purchase accounting accretion, was 5.53% for the quarter ended December 31, 2022, compared to 4.86% for the linked quarter. The yield on total investment securities was 2.34% for the three months ended December 31, 2022, compared to 2.12% for the linked quarter. Additionally, the rate on interest-bearing deposits increased to 1.54% for the quarter ended December 31, 2022, compared to 0.64% for the quarter ended September 30, 2022, and average interest-bearing deposit balances increased to $5.12 billion from $4.83 billion for the linked quarter. Average balances of subordinated indebtedness also increased to $201.7 million for the quarter ended December 31, 2022, compared to $186.8 million for the linked quarter due to subordinated indebtedness assumed in the BTH merger in August 2022, and reflected a rate of 4.95% for the current quarter compared to 4.81% for the linked quarter.

The fully tax-equivalent NIM was 3.81% for the quarter ended December 31, 2022, a 13 and a 75 basis point increase compared to the linked quarter and the prior year quarter, respectively. The yield earned on interest-earning assets for the quarter ended December 31, 2022, was 4.96%, an increase of 73 and 161 basis points compared to the linked quarter and the prior year quarter, respectively. The rate paid on total deposits for the quarter ended December 31, 2022, was 1.02%, representing a 61 and an 83 basis point increase compared to the linked quarter and the prior year quarter. The rate paid on subordinated indebtedness also increased to 4.95%, reflecting a 14 and a 33 basis point increase compared to the linked quarter and prior year quarter, respectively. The net increase in accretion income due to the BTH merger increased the fully tax- equivalent NIM by approximately eight basis points and seven basis points, respectively, during the current quarter and the linked quarter.

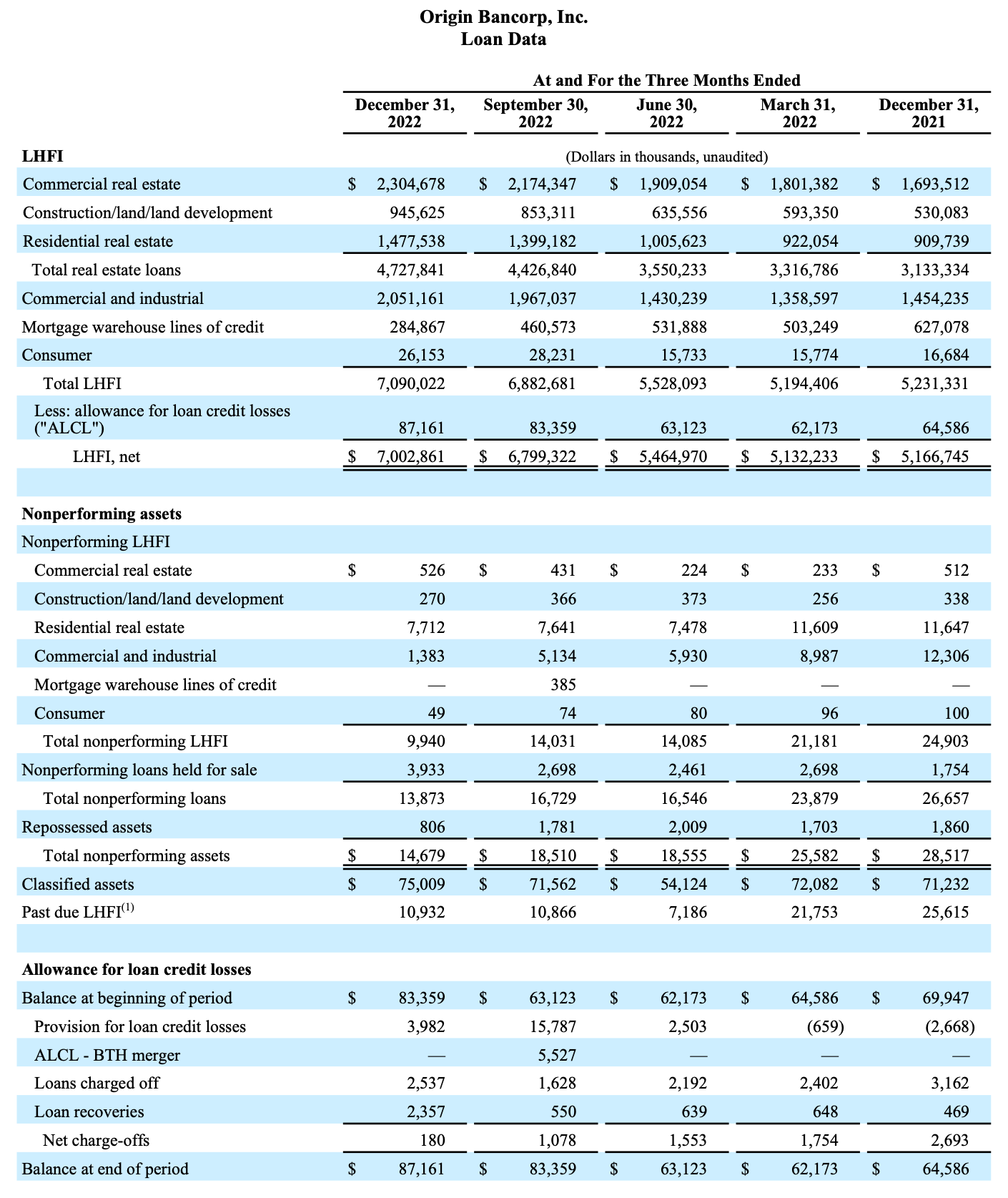

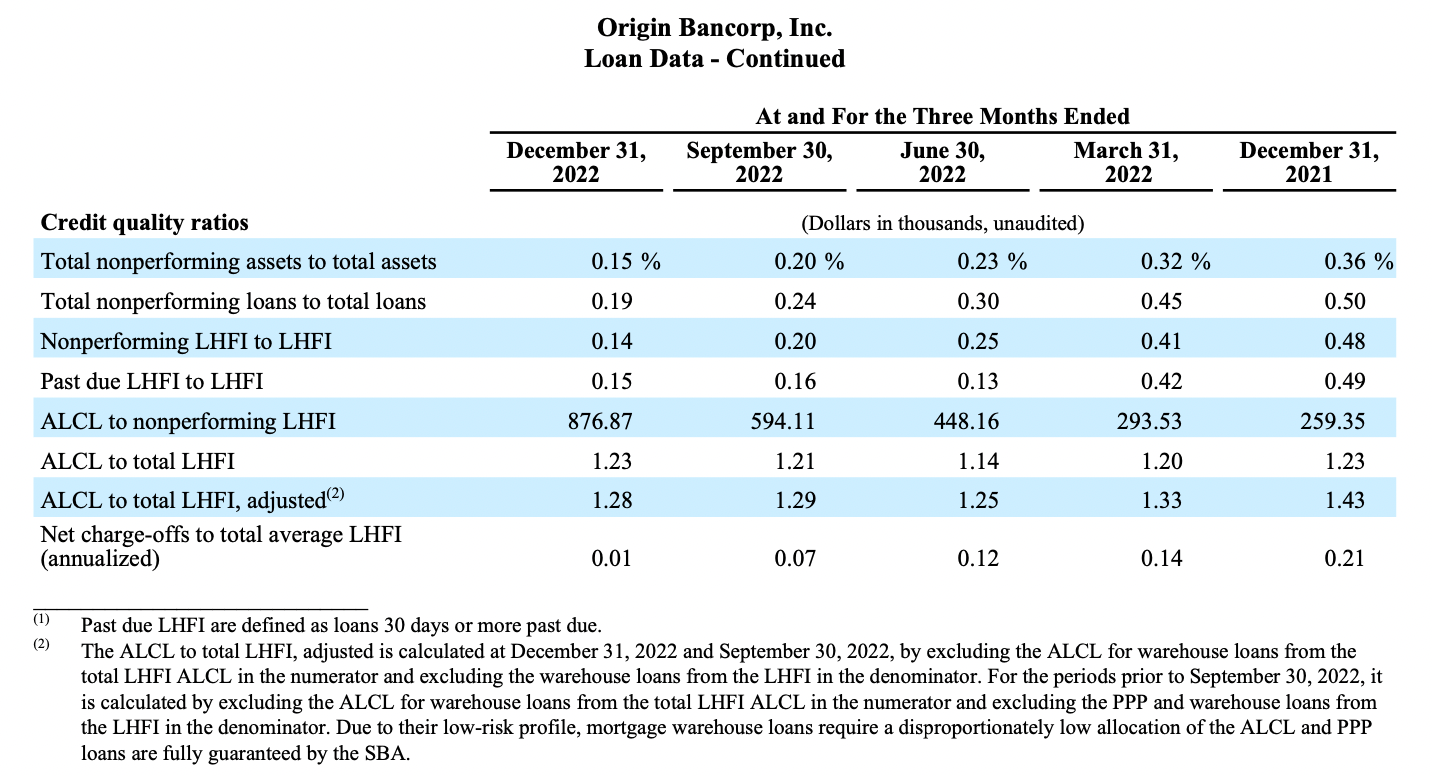

Credit Quality

The table below includes key credit quality information:

The Company recorded a credit loss provision of $4.6 million during the quarter ended December 31, 2022, compared to a credit loss provision of $16.9 million recorded during the linked quarter. The decrease is primarily due to a $14.9 million Day 1 CECL loan provision recorded during the quarter ended September 30, 2022, for the merger with BTH.

Overall, most credit metrics improved at December 31, 2022, when compared to the linked quarter. The ALCL to nonperforming LHFI increased to 876.9% at December 31, 2022, compared to 594.1% at September 30, 2022, driven by the $3.8 million increase in the Company’s ALCL for the quarter and a $4.1 million decrease in nonperforming LHFI. Quarterly net charge-offs decreased to $180,000 from $1.1 million for the linked quarter, primarily due to a $1.8 million recovery on a commercial and industrial loan during the current quarter. Net charge-offs to total average LHFI (annualized) decreased to 0.01% for the quarter ending December 31, 2022, compared to 0.07% for the quarter ending September 30, 2022. Classified loans increased $4.4 million at December 31, 2022, compared to the linked quarter, and represented 1.05% of LHFI, at December 31, 2022, compared to 1.01% at September 30, 2022. The ALCL to total LHFI increased to 1.23% at December 31, 2022, compared to 1.21% at September 30, 2022.

Noninterest Income

Noninterest income for the quarter ended December 31, 2022, was $13.4 million, a decrease of $294,000, or 2.1%, from the linked quarter. The decrease from the linked quarter was primarily driven by decreases of $1.7 million and $612,000 on the gain on sales of securities, net and insurance commission and fee income, respectively, offset by an increase of $2.1 million in mortgage banking revenue.

The gain on sales of securities, net, decreased $1.7 million when compared to the quarter ended September 30, 2022, due to the sale of primarily legacy BTH securities during the quarter ended September 30, 2022, as a result of investment strategy and liquidity management, while no sale transactions occurred during the current quarter. The $612,000 decrease in insurance commission and fee income was caused by the seasonality of policy renewals.

The $2.1 million increase in mortgage banking revenue compared to the linked quarter was primarily due to a $2.0 million impairment of the GNMA MSR portfolio recognized during the quarter ended September 30, 2022, without a similar sale occurring during the current quarter. During the quarter ended December 31, 2022, the Company entered into a contract to transfer the servicing of these GNMA loans to a third party, the unpaid principal balance of these loans were approximately $453.3 million at December 31, 2022. The sale of the MSR portfolio on these loans is expected to settle in the first quarter of 2023, with no significant gain or loss expected at settlement.

Noninterest Expense

Noninterest expense for the quarter ended December 31, 2022, was $57.3 million, an increase of $1.0 million compared to the linked quarter. The increase from the linked quarter was primarily driven by increases of $1.5 million, $682,000, $464,000, $365,000 and $309,000 in salaries and employee benefits, intangible asset amortization, occupancy and equipment, net, regulatory assessments and advertising and marketing expenses, respectively. The total increase was partially offset by decreases of $2.4 million and $432,000 in merger-related expense and other noninterest expense, respectively.

The $1.5 million increase in salaries and employee benefits expense was primarily driven by a $1.0 million increase related to an additional month of BTH expenses. The remaining increase was driven by an additional incentive accrual recorded during the current quarter due to exceeding performance metrics during the period.

The $682,000 increase in intangible asset amortization expense was due to the additional month of expense in the current quarter due to the timing of closing of the BTH merger.

The $464,000 increase in occupancy and equipment, net expense was primarily driven by a $357,000 increase in contractual rent expense due to the timing of the closing of the merger and one new banking center location.

The $365,000 increase in regulatory assessments expense was due to a change in the assessment rate during the quarter ended September 30, 2022, as well as growth in average assets primarily due to the BTH merger.

The $309,000 increase in advertising and marketing expenses was due to expenses associated with marketing campaigns.

Merger-related expenses declined $2.4 million compared to the quarter ended September 30, 2022, primarily due to $2.8 million in professional services fees incurred during the quarter ended September 30, 2022.

The $432,000 decrease in other noninterest expense was mainly due to system integration savings realized in conjunction with the BTH merger.

Income Taxes

The effective tax rate was 18.8% during the quarter ended December 31, 2022, compared to 14.8% during the linked quarter and 14.6% during the quarter ended December 31, 2021. The effective tax rate for the quarter ended September 30, 2022, was lower due to tax-exempt items and credits having a larger than proportional effect on the Company's effective income tax rate as income before taxes decreases. Merger expenses incurred during the quarter ended September 30, 2022, caused the income before income taxes to be lower compared to the current quarter and the quarter ended December 31, 2021.

The effective tax rate for the quarter ended December 31, 2021, was lower compared to the effective tax rate for the quarter ended December 31, 2022, primarily due to the tax impact of the exercise of stock options and vesting of stock awards during the quarter ended December 31, 2021.

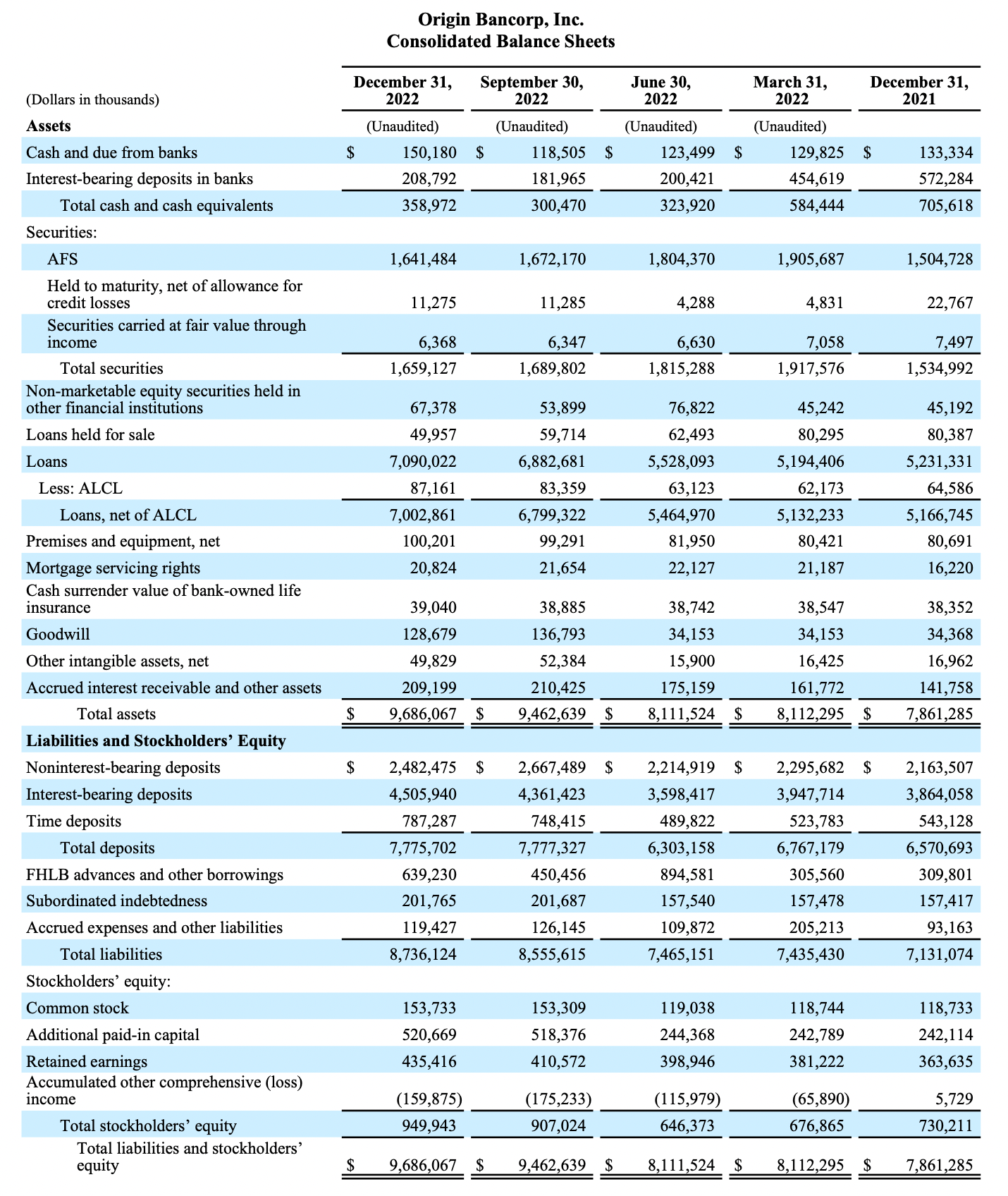

Financial Condition

Loans

• Total LHFI at December 31, 2022, were $7.09 billion, an increase of $207.3 million, or 3.0%, from $6.88 billion at September 30, 2022, and an increase of $1.86 billion, or 35.5%, compared to December 31, 2021.

• Total real estate loans were $4.73 billion at December 31, 2022, an increase of $301.0 million, or 6.8%, from the linked quarter. Mortgage warehouse lines of credit totaled $284.9 million at December 31, 2022, a decrease of $175.7 million, or 38.1%, compared to the linked quarter.

• The largest contributor to the increase in LHFI was commercial real estate which increased $130.3 million, or 6.0%, compared to the linked quarter.

Securities

• Total securities at December 31, 2022, were $1.66 billion, a decrease of $30.7 million, or 1.8%, compared to the linked quarter and an increase of $124.1 million, or 8.1%, compared to December 31, 2021.

• The decrease was due to maturities, scheduled principal payments, and calls; there were no security sales during the current quarter.

• Accumulated other comprehensive loss, net of taxes, associated with the AFS portfolio improved by $15.4 million during the quarter ended December 31, 2022.

• The total securities portfolio effective duration was 5.1 years as of December 31, 2022, compared to 5.2 years as of September 30, 2022.

Deposits

• Total deposits at December 31, 2022, were $7.78 billion, a decrease of $1.6 million compared to the linked quarter, and represented an increase of $1.21 billion, or 18.3%, from December 31, 2021.

• For the quarters ended December 31, 2022, and December 31, 2021, average noninterest-bearing deposits as a percentage of total average deposits were 33.6%, compared to 34.9% for the quarter ended September 30, 2022.

Borrowings

• FHLB advances and other borrowings at December 31, 2022, were $639.2 million, an increase of $188.8 million, or 41.9%, compared to the linked quarter and represented an increase of $329.4 million, or 106.3%, from December 31, 2021.

• Average FHLB advances were $511.9 million for the quarter ended December 31, 2022, a decrease of $12.0 million from $523.9 million for the quarter ended September 30, 2022.

Stockholders’ Equity

• Stockholders’ equity was $949.9 million at December 31, 2022, an increase of $42.9 million, or 4.7%, compared to $907.0 million at September 30, 2022, and an increase of $219.7 million, compared to $730.2 million, or 30.1%, at December 31, 2021.

• The increase in stockholders’ equity from the linked quarter is primarily due to net income of $29.5 million and an increase in other comprehensive income, net of tax, of $15.4 million retained during the current quarter.

• The increase from December 31, 2021, is primarily associated with the BTH merger, which drove a $306.3 million increase in stockholders' equity and net income retained during the year ended December 31, 2022, partially offset by other comprehensive loss, net of tax and dividends declared during the year.

Conference Call

Origin will hold a conference call to discuss its fourth quarter and 2022 full year results on Thursday, January 26, 2023, at 8:00 a.m. Central Time (9:00 a.m. Eastern Time). To participate in the live conference call, please dial +1 (929) 272-1574 (U.S. Local / International); +1 (800) 528-1066 (U.S. Toll Free), enter Conference ID: 83933 and request to be joined into the Origin Bancorp, Inc. (OBNK) call. A simultaneous audio-only webcast may be accessed via Origin’s website at www.origin.bank under the investor relations, News & Events, Events & Presentations link or directly by visiting https:// dealroadshow.com/e/ORIGINQ422.

If you are unable to participate during the live webcast, the webcast will be archived on the Investor Relations section of Origin’s website at www.origin.bank, under Investor Relations, News & Events, Events & Presentations.

About Origin

Origin Bancorp, Inc. is a financial holding company headquartered in Ruston, Louisiana. Origin’s wholly owned bank subsidiary, Origin Bank, was founded in 1912 in Choudrant, Louisiana. Deeply rooted in Origin’s history is a culture committed to providing personalized, relationship banking to businesses, municipalities, and personal clients to enrich the lives of the people in the communities it serves. Origin provides a broad range of financial services and currently operates 59 banking centers located from Dallas/Fort Worth, East Texas and Houston, across North Louisiana and into Mississippi. For more information, visit www.origin.bank.

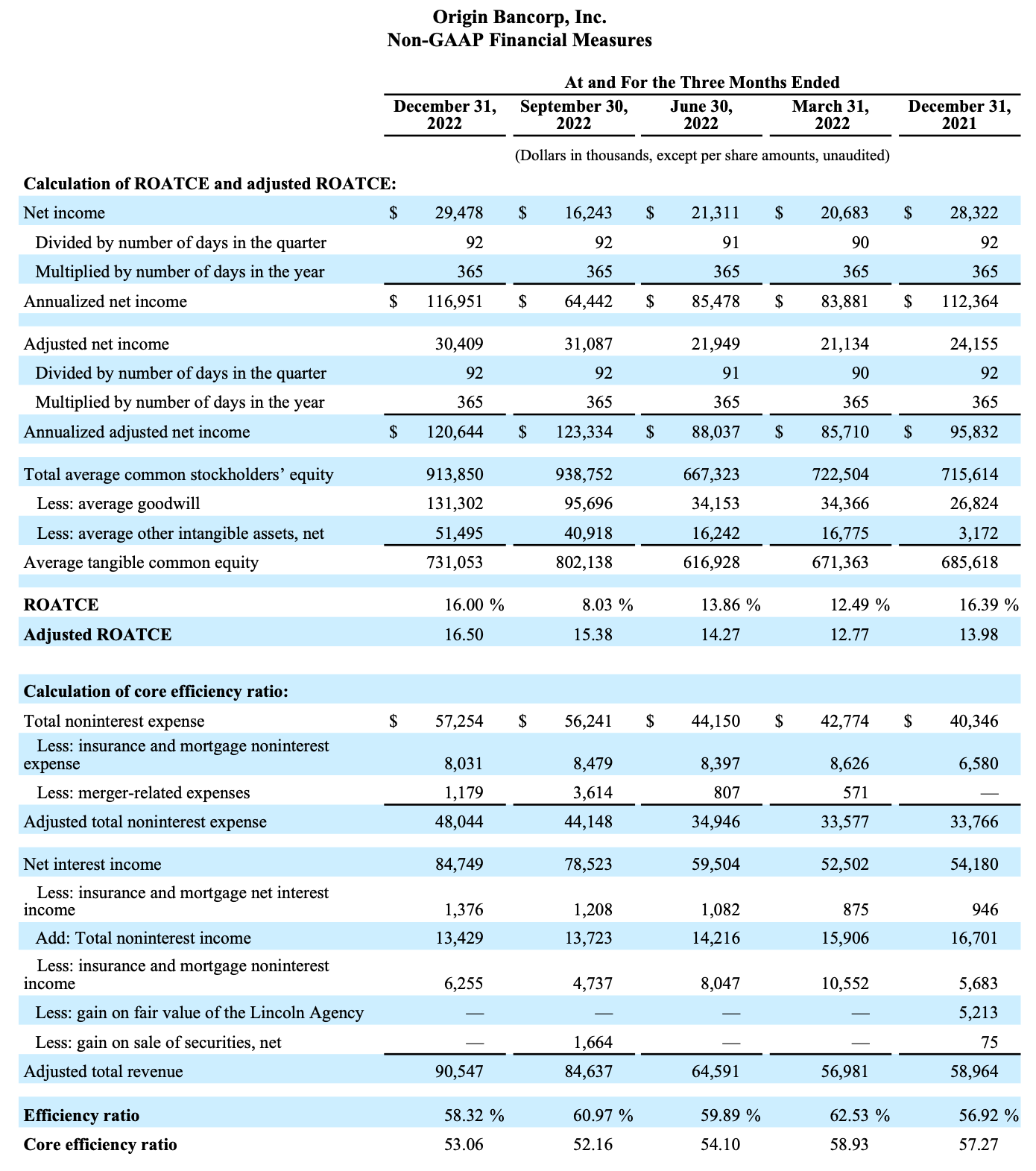

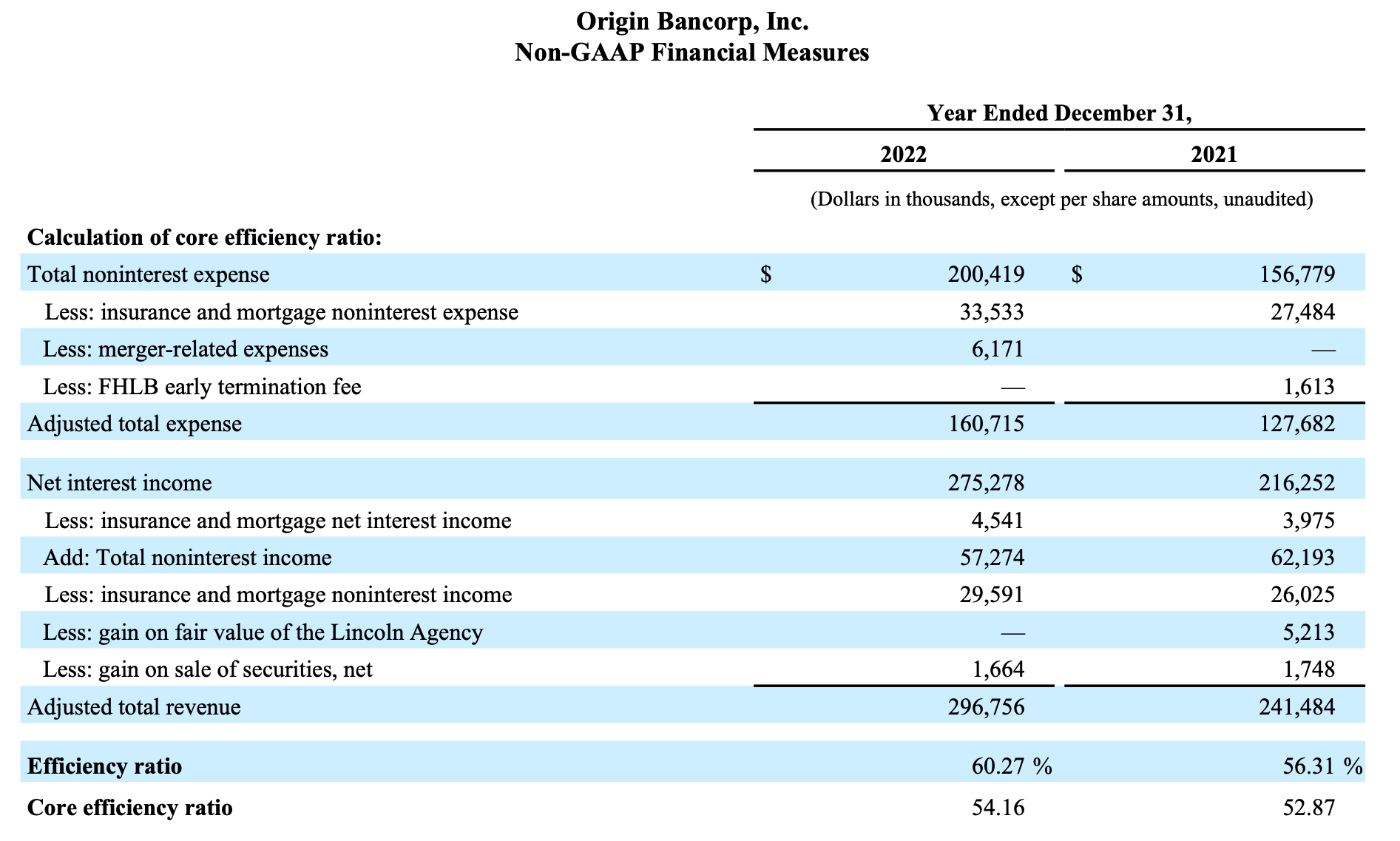

Non-GAAP Financial Measures

Origin reports its results in accordance with United States generally accepted accounting principles ("GAAP"). However, management believes that certain supplemental non-GAAP financial measures used in managing its business may provide meaningful information to investors about underlying trends in its business. Management uses these non-GAAP measures to evaluate the Company's operating performance and believes that these non-GAAP measures provide information that is important to investors and that is useful in understanding Origin's results of operations. However, non-GAAP financial measures are supplemental and should be viewed in addition to, and not as an alternative for, Origin's reported results prepared in accordance with GAAP. The following are the non-GAAP measures used in this release: adjusted net income, adjusted PTPP earnings, adjusted diluted EPS, NIM- FTE, adjusted, adjusted ROAA, adjusted PTPP ROAA, adjusted ROAE, adjusted PTPP ROAE, tangible book value per common share, adjusted tangible book value per common share, ROATCE and adjusted ROATCE and core efficiency ratio.

Please see the last few pages of this release for reconciliations of non-GAAP measures to the most directly comparable financial measures calculated in accordance with GAAP.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information regarding Origin’s future financial performance, business and growth strategy, projected plans and objectives, and any expected purchases of its outstanding common stock, and related transactions and other projections based on macroeconomic and industry trends, including expectations regarding and efforts to respond to the COVID-19 pandemic and changes to interest rates by the Federal Reserve and the resulting impact on Origin’s results of operations, estimated forbearance amounts and expectations regarding the Company’s liquidity, including in connection with advances obtained from the FHLB, which are all subject to change and may be inherently unreliable due to the multiple factors that impact broader economic and industry trends, and any such changes may be material. Such forward- looking statements are based on various facts and derived utilizing important assumptions and current expectations, estimates and projections about Origin and its subsidiaries, any of which may change over time and some of which may be beyond Origin’s control. Statements or statistics preceded by, followed by or that otherwise include the words “assumes,” “anticipates,” “believes,” “estimates,” “expects,” “foresees,” “intends,” “plans,” “projects,” and similar expressions or future or conditional verbs such as “could,” “may,” “might,” “should,” “will,” and “would” and variations of such terms are generally forward- looking in nature and not historical facts, although not all forward-looking statements include the foregoing words. Further, certain factors that could affect Origin’s future results and cause actual results to differ materially from those expressed in the forward-looking statements include, but are not limited to: the impact of current and future economic conditions generally and in the financial services industry, nationally and within Origin’s primary market areas, including the effects of declines in the real estate market, high unemployment rates, inflationary pressures, elevated interest rates and slowdowns in economic growth, as well as the financial stress on borrowers and changes to customer and client behavior as a result of the foregoing, deterioration of Origin’s asset quality; factors that can impact the performance of Origin’s loan portfolio, including real estate values and liquidity in Origin’s primary market areas; the financial health of Origin’s commercial borrowers and the success of construction projects that Origin finances; changes in the value of collateral securing Origin’s loans; developments in our mortgage banking business, including loan modifications, general demand, and the effects of judicial or regulatory requirements or guidance; Origin’s ability to anticipate interest rate changes and manage interest rate risk, (including the impact of higher interest rates on macroeconomic conditions, competition, and the cost of doing business); the effectiveness of Origin’s risk management framework and quantitative models; Origin’s inability to receive dividends from Origin Bank and to service debt, pay dividends to Origin’s common stockholders, repurchase Origin’s shares of common stock and satisfy obligations as they become due; the impact of supply-chain disruptions and labor pressures; changes in Origin’s operation or expansion strategy or Origin’s ability to prudently manage its growth and execute its strategy; changes in management personnel; Origin’s ability to maintain important customer relationships, reputation or otherwise avoid liquidity risks; increasing costs as Origin grows deposits; operational risks associated with Origin’s business; volatility and direction of market interest rates; significant turbulence or a disruption in the capital or financial markets and the effect of a fall in stock market prices on our investment securities; increased competition in the financial services industry, particularly from regional and national institutions, as well as from fintech companies; difficult market conditions and unfavorable economic trends in the United States generally, and particularly in the market areas in which Origin operates and in which its loans are concentrated; an increase in unemployment levels and slowdowns in economic growth; Origin’s level of nonperforming assets and the costs associated with resolving any problem loans including litigation and other costs; the credit risk associated with the substantial amount of commercial real estate, construction and land development, and commercial loans in Origin’s loan portfolio; changes in laws, rules, regulations, interpretations or policies relating to financial institutions, and potential expenses associated with complying with such regulations; periodic changes to the extensive body of accounting rules and best practices; further government intervention in the U.S. financial system; a deterioration of the credit rating for U.S. long-term sovereign debt, actions that the U.S. government may take to avoid exceeding the debt ceiling, or uncertainties surrounding the debt ceiling and the federal budget; compliance with governmental and regulatory requirements, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and others relating to banking, consumer protection, securities, and tax matters; Origin’s ability to comply with applicable capital and liquidity requirements, including its ability to generate liquidity internally or raise capital on favorable terms, including continued access to the debt and equity capital markets; changes in the utility of Origin’s non-GAAP liquidity measurements and its underlying assumptions or estimates; uncertainty regarding the transition away from the London Interbank Offered Rate and the impact of any replacement alternatives such as the Secured Overnight Financing Rate on Origin’s business; possible changes in trade, monetary and fiscal policies, laws and regulations and other activities of governments, agencies and similar organizations; natural disasters and adverse weather events, acts of terrorism, an outbreak of hostilities (including the impacts related to or resulting from Russia's military action in Ukraine, including the imposition of additional sanctions and export controls, as well as the broader impacts to financial markets and the global macroeconomic and geopolitical environments), regional or national protests and civil unrest (including any resulting branch closures or property damage), widespread illness or public health outbreaks or other international or domestic calamities, and other matters beyond Origin’s control; and system failures, cybersecurity threats or security breaches and the cost of defending against them. For a discussion of these and other risks that may cause actual results to differ from expectations, please refer to the sections titled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Origin’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission and any updates to those sections set forth in Origin’s subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Origin’s underlying assumptions prove to be incorrect, actual results may differ materially from what Origin anticipates. Accordingly, you should not place undue reliance on any forward-looking statements. Any forward- looking statement speaks only as of the date on which it is made, and Origin does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

New risks and uncertainties arise from time to time, and it is not possible for Origin to predict those events or how they may affect Origin. In addition, Origin cannot assess the impact of each factor on Origin’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Furthermore, many of these risks and uncertainties are currently amplified by, may continue to be amplified by, or may, in the future, be amplified by the COVID-19 pandemic and the impact of varying governmental responses that affect Origin's customers and the economies where they operate. All forward-looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Origin or persons acting on Origin’s behalf may issue. Annualized, pro forma, adjusted, projected, and estimated numbers are used for illustrative purposes only, are not forecasts, and may not reflect actual results.

Contact:

Investor Relations

Chris Reigelman, 318-497-3177, chris@origin.bank

Media Contact

Ryan Kilpatrick, 318-232-7472, rkilpatrick@origin.bank