Origin Bancorp, Inc. Reports Earnings for Second Quarter 2022

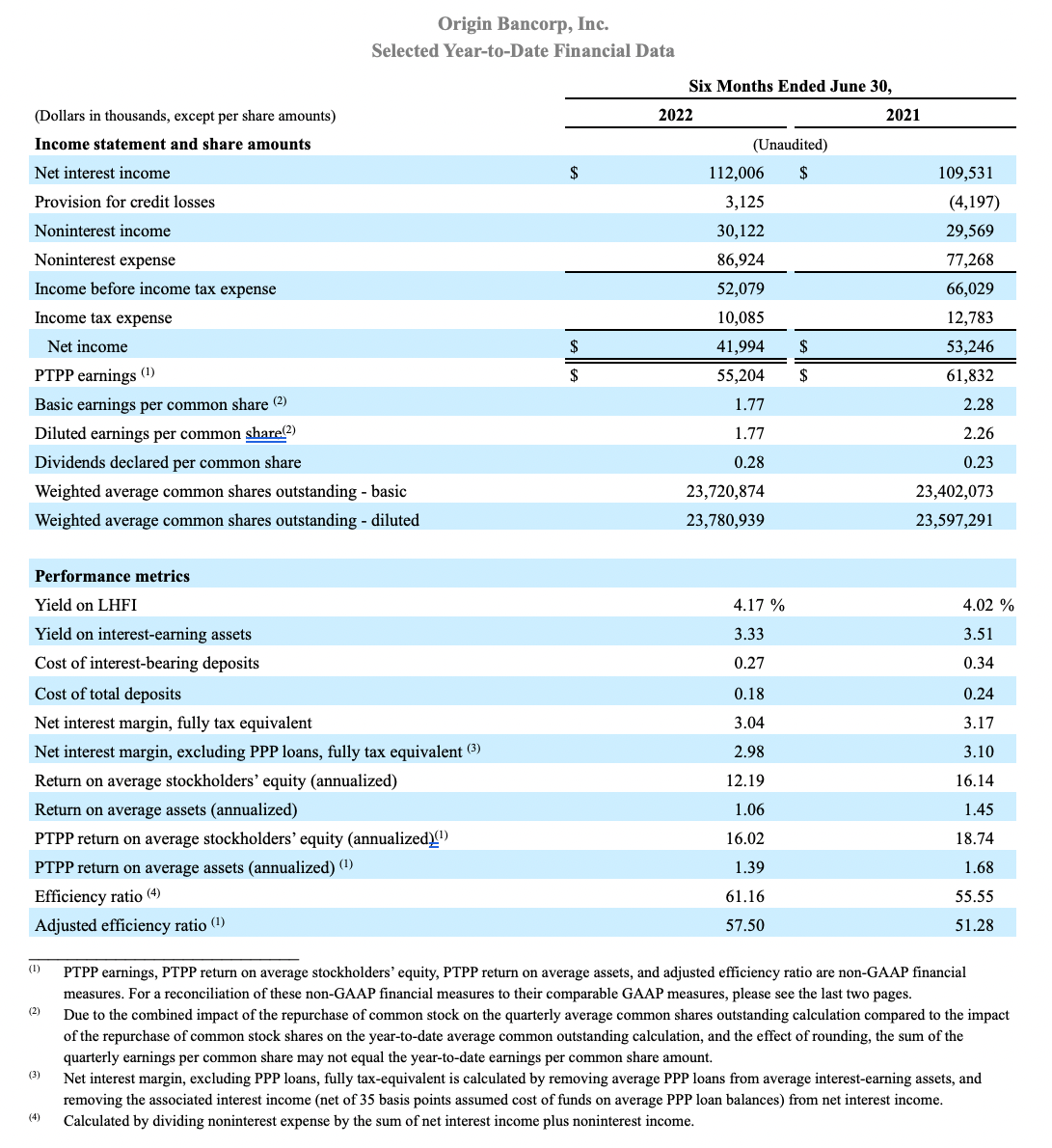

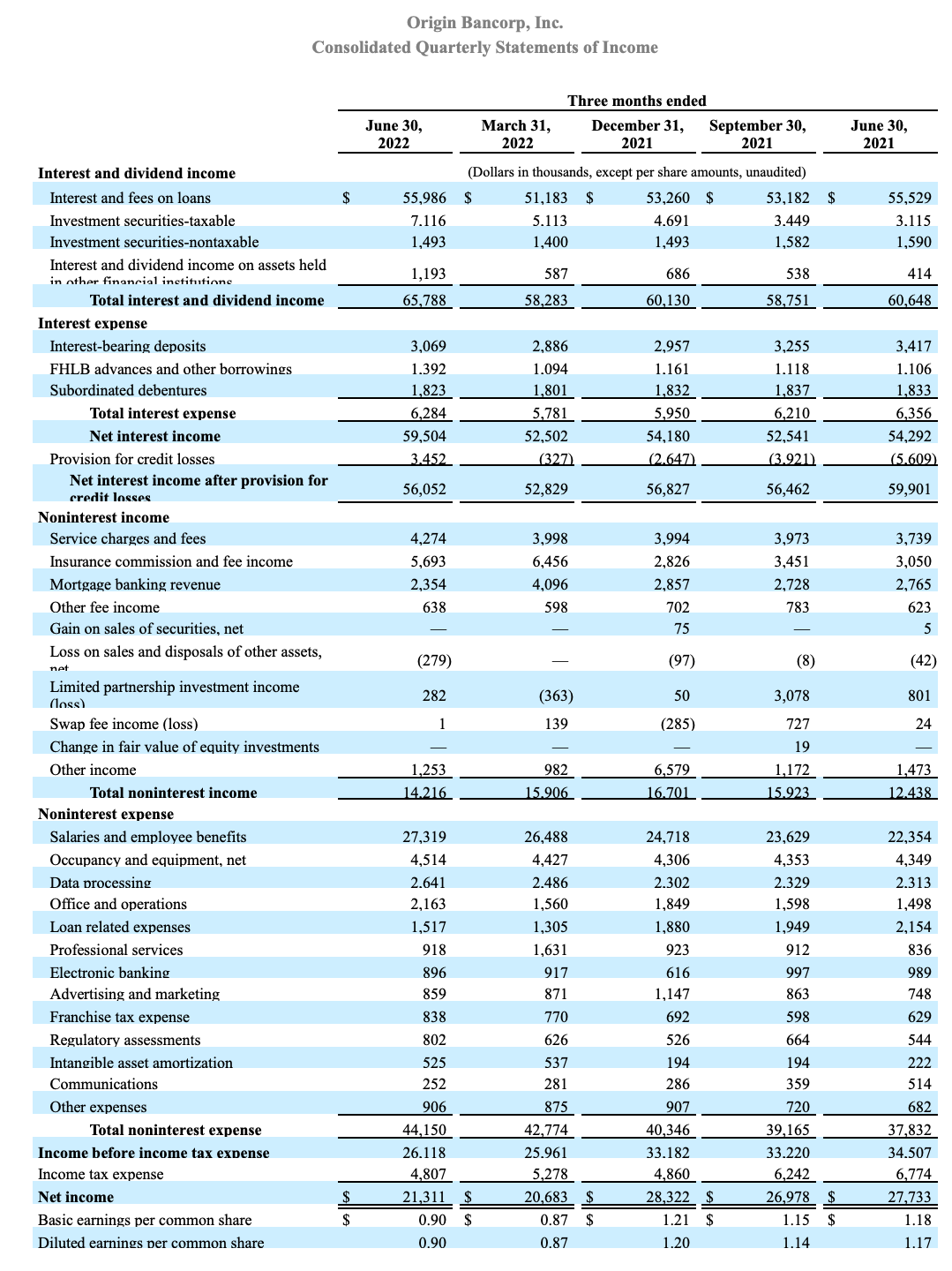

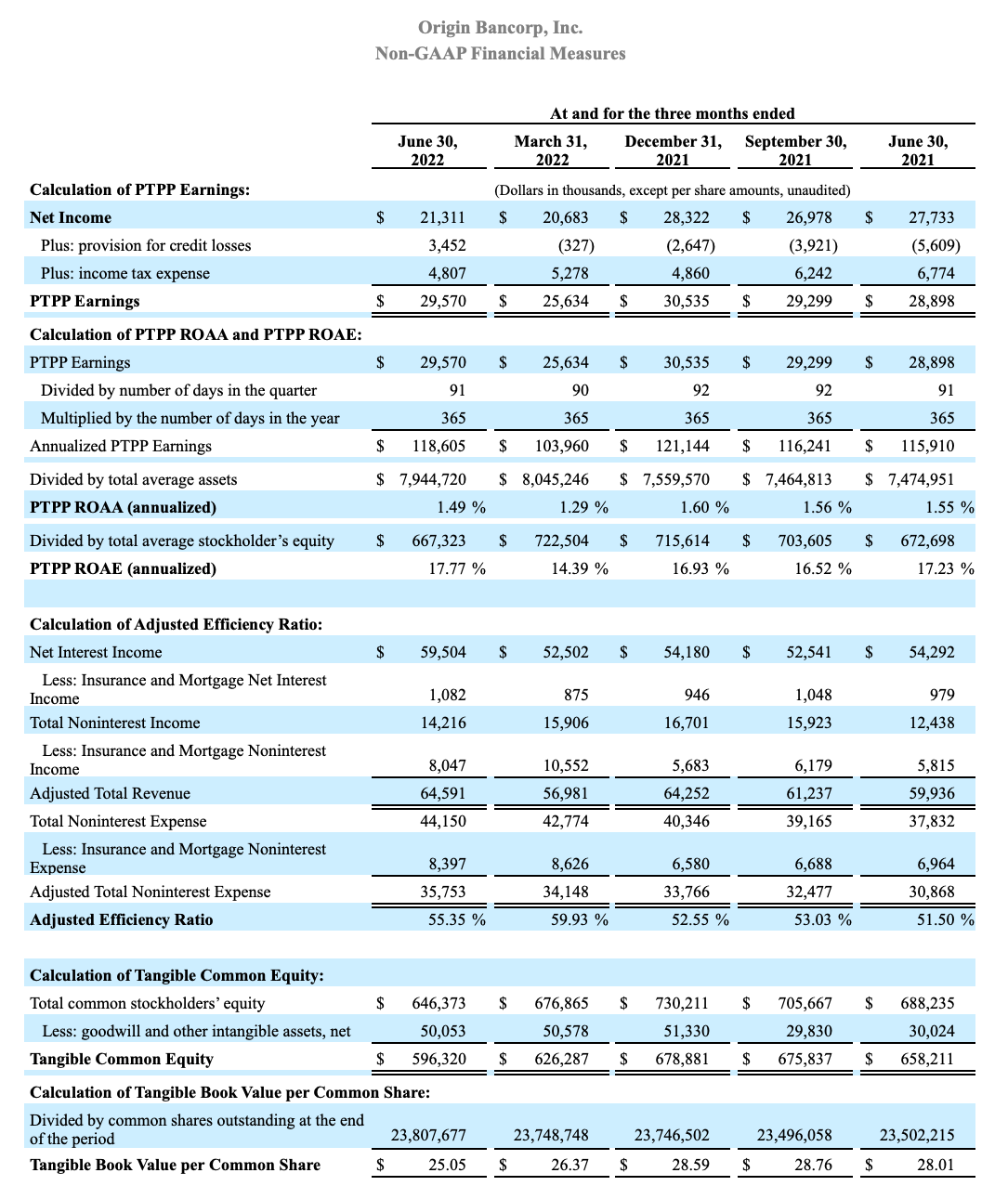

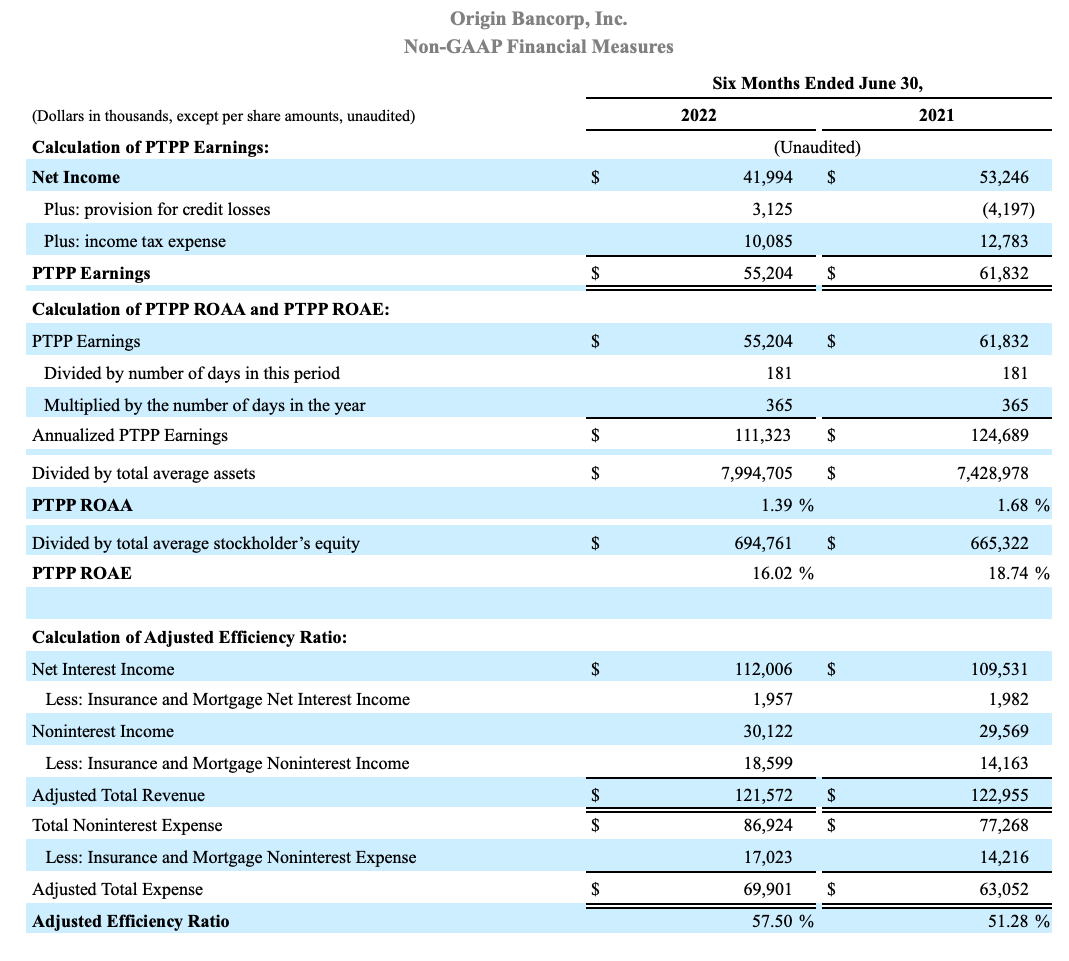

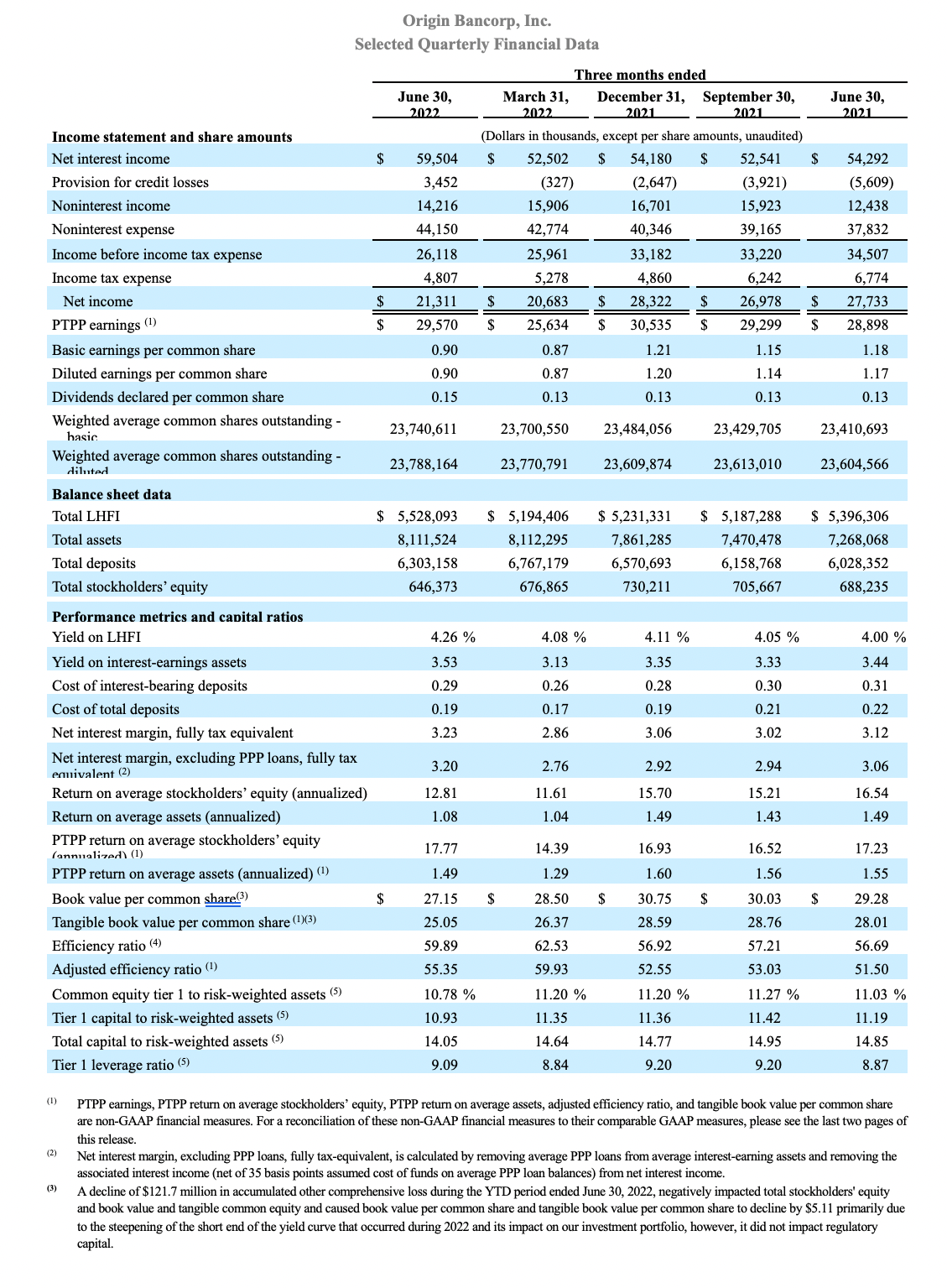

Origin Bancorp, Inc. (Nasdaq: OBNK) (“Origin” or the “Company”), the holding company for Origin Bank (the “Bank”), today announced net income of $21.3 million, or $0.90 diluted earnings per share for the quarter ended June 30, 2022, compared to $20.7 million, or $0.87 diluted earnings per share, for the quarter ended March 31, 2022, and compared to net income of $27.7 million, or $1.17 diluted earnings per share for the quarter ended June 30, 2021.

“Origin performed extremely well in the second quarter as we saw impressive results in many key financial metrics. I’m extremely pleased with how we delivered for our clients with an annualized loan growth rate of twenty-nine percent while maintaining strong credit discipline,” said Drake Mills, chairman, president and CEO of Origin Bancorp, Inc. “We have also received all regulatory and shareholder approvals for the BTH partnership and we look forward to our two companies coming together to positively impact our employees, customers, communities and shareholders.”

Second Quarter Financial Highlights

• The fully tax-equivalent net interest margin (“NIM”) was 3.23% for the quarter ended June 30, 2022, reflecting a robust 37 basis point increase from the linked quarter and an 11 basis point increase from the quarter ended June 30, 2021.

• Net interest income for the quarter ended June 30, 2022, was $59.5 million, reflecting a $7.0 million, or 13.3%, increase compared to the linked quarter, and a $5.2 million, or 9.6% increase, compared to the quarter ended June 30, 2021.

• Total loans held for investment (“LHFI”) at June 30, 2022, excluding PPP loans and mortgage warehouse lines of credit, were $5.0 billion, reflecting a strong $336.3 million or 29.0% annualized increase, compared to the linked quarter, and an $834.2 million, or 20.0% increase, compared to June 30, 2021.

• Average balances of total securities for the quarter ended June 30, 2022, were $1.87 billion, reflecting a $206.6 million, or 12.4%, increase compared to the linked quarter, and a $838.5 million, or 81.4% increase, compared to the quarter ended June 30, 2021. Total securities were $1.82 billion at June 30, 2022, compared to $1.92 billion at March 31, 2022, and $1.02 billion at June 30, 2021.

• Provision for credit losses was a net expense of $3.5 million for the quarter ended June 30, 2022, compared to net benefit of $327,000 and $5.6 million for the linked quarter and the quarter ended June 30, 2021, respectively.

• Total nonperforming LHFI to total LHFI was 0.25% at June 30, 2022, compared to 0.41% at March 31, 2022, and 0.57% at June 30, 2021, reflecting a 33.5% and 53.8% decrease in total nonperforming LHFI when compared to the linked quarter and June 30, 2021, respectively. The allowance for loan credit losses to nonperforming LHFI was 448.16% at June 30, 2022, compared to 293.53% and 252.78% at March 31, 2022, and June 30, 2021, respectively.

• On February 23, 2022, the Company entered into an agreement and plan of merger with BT Holdings, Inc., (“BTH”), pursuant to which, upon the terms and subject to the conditions set forth in the merger agreement, BTH will merge with and into the Company, with Origin Bancorp, Inc. as the surviving entity in the merger. On June 30, 2022, the Company and BTH issued a joint press release announcing that the shareholders of the Company and BTH had each approved the merger agreement and the transactions contemplated by the merger agreement, including the merger and the merger of BTH Bank, N.A., with and into Origin Bank (the “bank merger”). In addition, the press release announced that the Company had received the requisite regulatory approvals from the Federal Reserve Bank of Dallas, Louisiana Office of Financial Institutions, and Texas Department of Banking for the merger and the bank merger. The proposed merger is expected to close effective August 1, 2022, subject to the satisfaction of customary closing conditions.

Results of Operations for the Three Months Ended June 30, 2022

Net Interest Income and Net Interest Margin

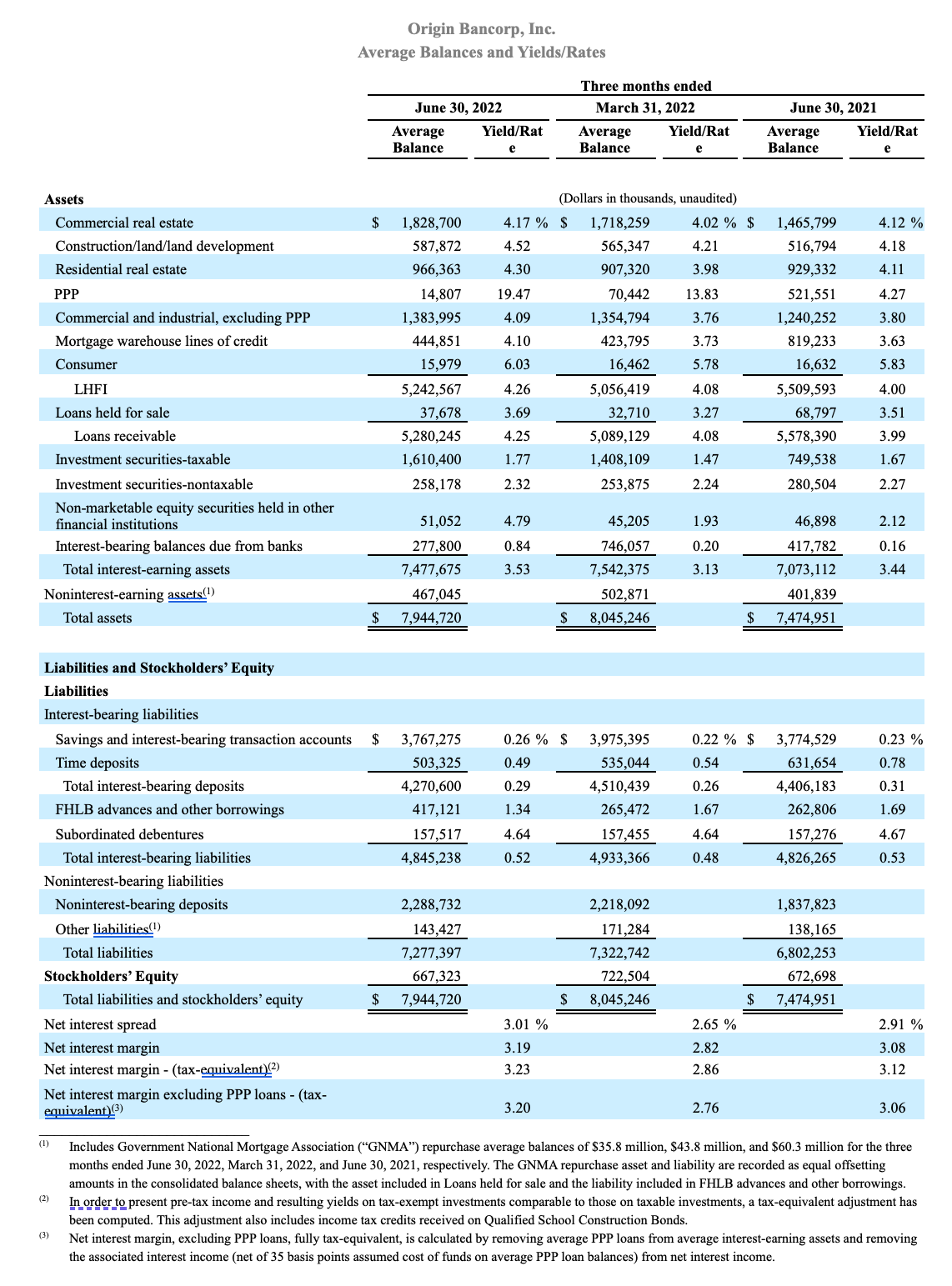

Net interest income for the quarter ended June 30, 2022, was $59.5 million, an increase of $7.0 million, or 13.3%, compared to the linked quarter. The increase was primarily due to increases of $4.2 million, $2.1 million, and $1.6 million in interest earned on real estate loans, investment securities and commercial and industrial loans excluding PPP loans, respectively, offset by a $1.7 million decrease in interest income and fees earned on PPP loans. A $192.0 million increase in average real estate loan balances contributed $1.9 million to the increase in interest income earned on real estate loans, while increases in market interest rates contributed another $2.3 million to the total increase in interest income earned on real estate loans. The increase in interest income earned on investment securities was driven by an increase in market rates, which contributed $1.3 million of the total $2.1 million increase. The increase in interest income earned on commercial and industrial loans, excluding PPP loans, was primarily driven by an increase in market interest rates, which contributed $1.3 million of the total $1.6 million increase. The decrease in interest income and fees earned on PPP loans was mainly due to the decrease in outstanding balances of PPP loans as they continued to be forgiven by the Small Business Administration ("SBA").

The yield earned on interest-earning assets for the quarter ended June 30, 2022, was 3.53%, an increase of 40 basis points compared to the linked quarter and an increase of nine basis points compared to the quarter ended June 30, 2021. The 40 basis point increase was primarily due to the reduction of $468.3 million of interest income on low yielding, interest bearing balances due from banks, and an 18 basis point increase in the yield of LHFI. The rate paid on total deposits for the quarter ended June 30, 2022, was 0.19%, representing a two basis point increase from the linked quarter and a three basis point decrease compared to the quarter ended June 30, 2021.

The fully tax-equivalent net interest margin was 3.23% for the quarter ended June 30, 2022, a 37 basis point increase and an 11 basis point increase from the linked quarter and the quarter ended June 30, 2021, respectively. Excluding PPP loans, the fully tax-equivalent NIM was 3.20%, a 44 basis point increase and a 14 basis point increase from the linked quarter and the quarter ended June 30, 2021, respectively. The increase in fully tax-equivalent NIM, excluding PPP loans, was primarily due to increases in market interest rates, which drove a net increase of $5.0 million in net interest income, as well as a shift in balance sheet composition from lower-yielding interest-bearing balances due from banks and investment securities to higher-yielding loans.

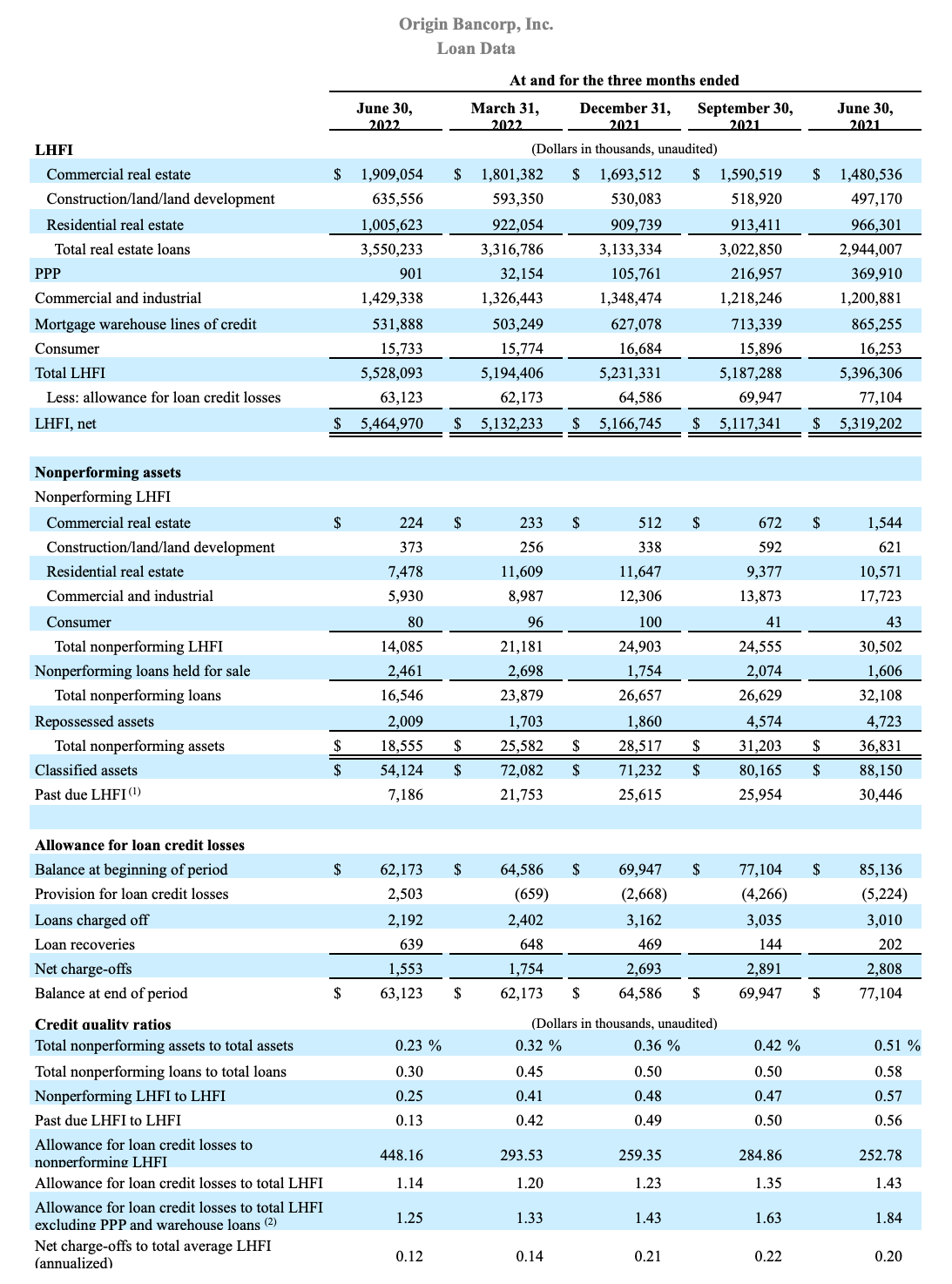

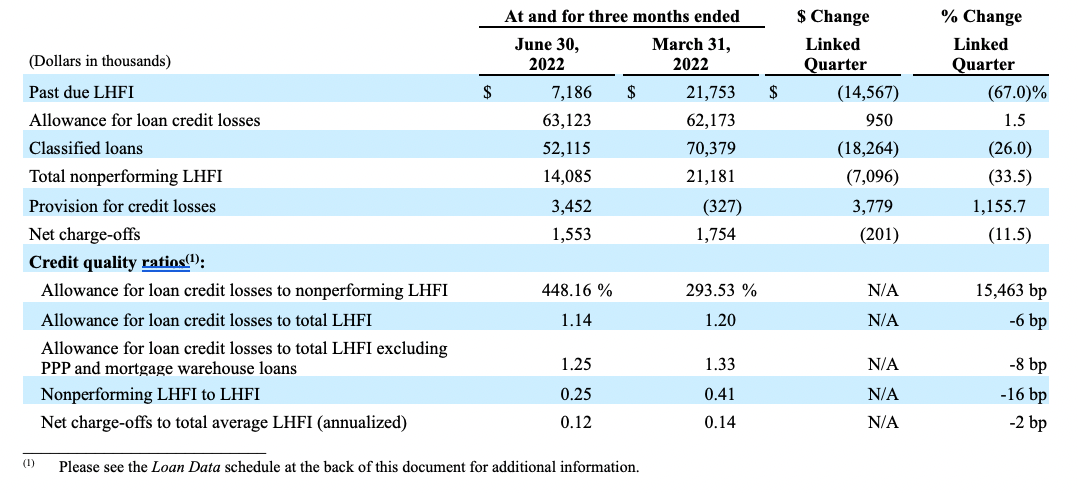

Credit Quality

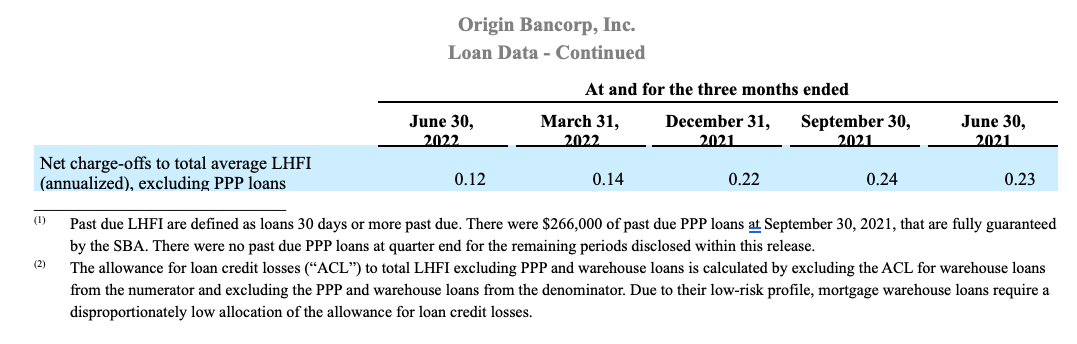

The table below includes key credit quality information:

The Company recorded a credit loss provision of $3.5 million during the quarter ended June 30, 2022, compared to a credit loss provision net benefit of $327,000 recorded during the linked quarter. The increase in credit loss provision is primarily due to a $333.7 million increase in total LHFI during the current quarter, somewhat offset by improved credit quality.

Significantly all credit metrics improved at June 30, 2022, when compared to the linked quarter. Past due loans to total LHFI declined to 0.13% as of June 30, 2022, compared to 0.42% for the linked quarter. The allowance for loan credit losses to nonperforming LHFI increased to 448.16% at June 30, 2022, compared to 293.53% at March 31, 2022, primarily driven by the $7.1 million reduction in the Company’s nonperforming LHFI for the quarter. Quarterly net charge-offs decreased to $1.6 million from $1.8 million for the linked quarter, decreasing to 0.12% (annualized) to total average LHFI for the quarter ending June 30, 2022, compared to 0.14% (annualized) for the quarter ending March 31, 2022. Classified loans decreased $18.3 million at June 30, 2022, compared to the linked quarter and represented 0.94% of LHFI, excluding PPP loans, at June 30, 2022, compared to 1.36% at March 31, 2022. As a result of the Company’s continued improving credit trends, the allowance for loan credit losses to total LHFI decreased to 1.14% at June 30, 2022, compared to 1.20% at March 31, 2022. While our credit metrics continue to improve, uncertainty remains due to risks related to continued inflation, market interest rate increases, labor pressures, continued global supply-chain disruptions, geopolitical risks, and economic recession concerns.

Noninterest Income

Noninterest income for the quarter ended June 30, 2022, was $14.2 million, a decrease of $1.7 million, or 10.6%, from the linked quarter. The decrease from the linked quarter was primarily driven by decreases of $1.7 million and $763,000 in mortgage banking revenue and insurance commission and fee income, respectively, offset by an increase of $645,000 in limited partnership investment income.

The $1.7 million decrease in mortgage banking revenue was primarily due to a loss on the loan pipeline, net of hedge, in the current quarter, compared to a gain recorded in the linked quarter, causing a decline of $1.2 million in mortgage banking revenue, as well as a $968,000 net decrease due to a change in valuation assumptions for the mortgage servicing rights ("MSR") asset. The loss on the loan pipeline was primarily due to a $21.5 million quarterly decrease in loan pipeline volume. The $763,000 decrease in insurance commission and fee income was primarily driven by seasonality, as there is typically higher insurance revenue in the first quarter of each year. The limited partnership investment income increased $645,000 when compared to the quarter ended March 31, 2022, primarily due to a decrease in the fair value of investments in one of the limited partnership funds during the first quarter of the 2022 year.

Noninterest Expense

Noninterest expense for the quarter ended June 30, 2022, was $44.2 million, an increase of $1.4 million compared to the linked quarter. This increase was primarily driven by increases of $831,000 and $603,000 in salaries and employee benefit expenses and office and operations expenses, respectively, offset by a $713,000 decrease in professional fees.

The $831,000 increase in salaries and employee benefit expense was primarily driven by the addition of 19 full time equivalent employees that were hired during the quarter and the full impact of cost of living adjustments and annual raises made on March 1, 2022, which were realized during the quarter ended June 30, 2022, as well as increased incentive accruals due to exceeding performance metrics during the period. The $603,000 increase in office and operations expenses was primarily due to an increase of $290,000 in business development costs. The $713,000 decrease in professional fees was primarily related to the recovery of legal fees related to nonperforming loans. Merger transaction expenses related to the proposed merger were $807,000 and $571,000 for the quarters ended June 30, 2022, and March 31, 2022, respectively.

Income Taxes

The effective tax rate was 18.4% during the quarter ended June 30, 2022, compared to 20.4% during the linked quarter and 19.6% during the quarter ended June 30, 2021. The effective tax rate for the quarter ended June 30, 2022, was lower due to the other comprehensive income loss experienced during the six months ended June 30, 2022, and its cumulative impact on the calculation of state income taxes.

Financial Condition

Loans

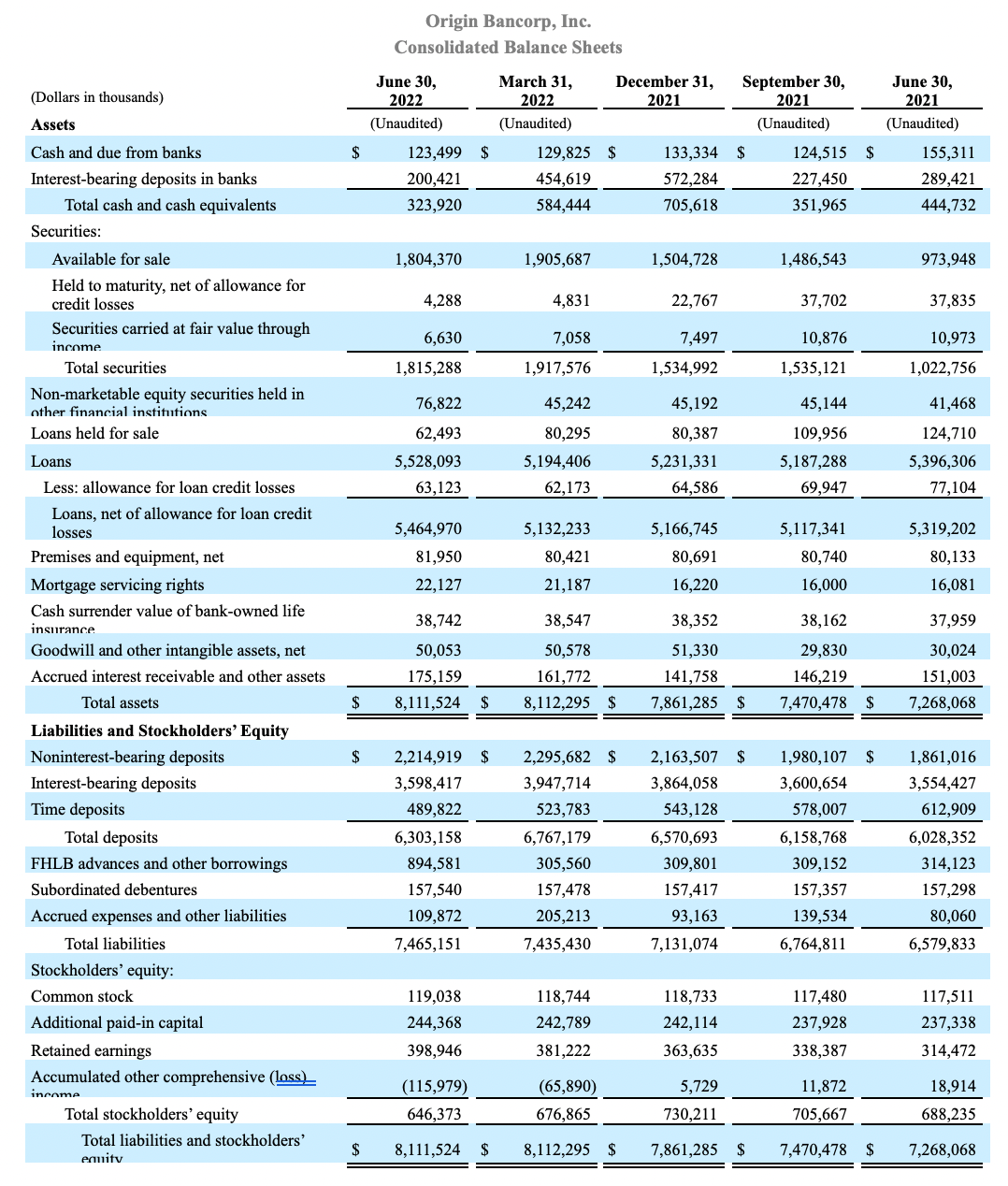

- Total LHFI increased $333.7 million compared to the linked quarter and $131.8 million compared to June 30, 2021.

- Total LHFI, excluding PPP and mortgage warehouse lines of credit, were $5.0 billion at June 30, 2022, reflecting a $336.3 million, or 29.0% annualized increase, compared to the linked quarter, and an $834.2 million, or 20.0% increase, compared to June 30, 2021.

- Mortgage warehouse lines of credit totaled $531.9 million at June 30, 2022, an increase of $28.6 million, or 5.7%, compared to the linked quarter, and a decrease of $333.4 million, or 38.5%, compared to June 30, 2021.

- Average LHFI increased $186.1 million compared to the linked quarter and decreased $267.0 million compared to the quarter ended June 30, 2021.

- Average LHFI, excluding PPP and mortgage warehouse lines of credit, increased $220.7 million compared to the linked quarter and increased $614.1 million compared to the quarter ended June 30, 2021.

Total LHFI at June 30, 2022, were $5.53 billion, reflecting an increase of 6.4% compared to the linked quarter and 2.4% compared to June 30, 2021. The increase in LHFI compared to the linked quarter was primarily driven by increases in real estate loans and commercial and industrial loans, excluding PPP.

Securities

- Total securities decreased $102.3 million compared to the linked quarter and increased $792.5 million compared to June 30, 2021. The current quarter decrease in the total securities portfolio was partially due to a $63.6 million decrease in the fair value of the available for sale portfolio. The total securities portfolio effective duration was 4.39 years as of June 30, 2022, compared to 4.29 years as of March 31, 2022.

- Average securities increased $206.6 million compared to the linked quarter and increased $838.5 million compared to the quarter ended June 30, 2021.

Total securities at June 30, 2022, were $1.82 billion, decreasing 5.3% compared to the linked quarter and increasing 77.5% compared to the quarter ended June 30, 2021. The increase in security balances compared to June 30, 2021, reflects a shift in balance sheet composition as liquidity surged primarily due to declines in mortgage warehouse lines of credit and PPP loan balances and increases in deposits. This trend has since stabilized with more normalized balances reflected in cash and cash equivalents and mortgage warehouse lines of credit, and with PPP loan balances at near zero levels, at June 30, 2022.

Deposits

- Total deposits decreased $464.0 million compared to the linked quarter and increased $274.8 million compared to June 30, 2021, respectively.

- Interest-bearing demand deposits declined $349.3 million, or 8.8%, compared to March 31, 2022, and grew $44.0 million, or 1.2%, compared to June 30, 2021.

- Noninterest-bearing deposits declined $80.8 million, or 3.5%, compared to March 31, 2022, and grew $353.9 million, or 19.0%, compared to June 30, 2021.

Money market public fund depositors and money market business depositors contributed decreases of $236.1 million and $116.1 million, respectively, to the $349.3 million decrease in interest-bearing demand deposits compared to the linked quarter, while noninterest-bearing business deposit balances contributed $91.7 million to the total $80.8 million decline in noninterest-bearing deposits. Business deposit balances increased $252.0 million, and were primarily responsible for the $274.8 million total increase in deposits when compared to June 30, 2021, balances. In order to manage deposit costs, the Company strategically allowed the attrition of non-relationship, higher-rate deposits during the current period.

For the quarter ended June 30, 2022, average noninterest-bearing deposits as a percentage of total average deposits were 34.9%, compared to 33.0% for the linked quarter and 29.4% for the quarter ended June 30, 2021.

Borrowings

Federal Home Loan Bank (“FHLB”) advances and other borrowings were $894.6 million at June 30, 2022, an increase of $589.0 million, or 192.8%, compared to the linked quarter and an increase of $580.5 million, or 184.8%, compared to the quarter ended June 30, 2021.

Average Federal Home Loan Bank (“FHLB”) advances and other borrowings for the quarter ended June 30, 2022, increased by $151.6 million or 57.1%, compared to the linked quarter, and by $154.3 million or 58.7%, compared to the quarter ended June 30, 2021. The increase in FHLB advances and other borrowings from both the linked quarter and from the quarter ended June 30, 2021, were driven by an increase in short-term borrowings during the respective periods as a result of liquidity management.

Stockholders’ Equity

Stockholders’ equity was $646.4 million at June 30, 2022, a decrease of $30.5 million compared to $676.9 million at March 31, 2022, and a decrease of $41.9 million compared to $688.2 million at June 30, 2021. The decrease from the linked quarter was primarily due to an additional $50.1 million in other comprehensive loss, net of tax, offset by net income for the quarter of $21.3 million. The decrease from June 30, 2021, was also primarily driven by other comprehensive loss, net of tax, and partially offset by net income retained during the intervening period.

Book value and tangible book value were impacted by an additional accumulated other comprehensive loss, net of tax, experienced primarily on the Company's available for sale securities portfolio during the six months ended June 30, 2022. The accumulated other comprehensive loss, net of tax, was $116.0 million at June 30, 2022, and $65.9 million at March 31, 2022, compared to an accumulated other comprehensive gain, net of tax, of $18.9 million at June 30, 2021. The accumulated other comprehensive loss did not impact the regulatory capital ratios.

Conference Call

Origin will hold a conference call to discuss its second quarter 2022 results on Thursday, July 28, 2022, at 8:00 a.m. Central Time (9:00 a.m. Eastern Time). To participate in the live conference call, please dial (888) 437-3179 (U.S. and Canada); and (862) 298-0702 (International), and request to be joined into the Origin Bancorp, Inc. (OBNK) call. A simultaneous audio-only webcast may be accessed via Origin’s website at www.origin.bank under the Investor Relations, News & Events, Events & Presentations link or directly by visiting: www.webcaster4.com/Webcast/Page/2864/45885.

If you are unable to participate during the live webcast, the webcast will be archived on the Investor Relations section of Origin’s website at www.origin.bank, under Investor Relations, News & Events, Events & Presentations.

About Origin Bancorp, Inc.

Origin is a financial holding company headquartered in Ruston, Louisiana. Origin’s wholly-owned bank subsidiary, Origin Bank, was founded in 1912. Deeply rooted in Origin’s history is a culture committed to providing personalized, relationship banking to its clients and communities. Origin provides a broad range of financial services to businesses, municipalities, high net-worth individuals and retail clients. Origin currently operates 45 banking centers located from Dallas/Fort Worth and Houston, Texas, across North Louisiana, and into Mississippi. For more information, visit www.origin.bank.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information regarding Origin’s future financial performance, business and growth strategy, projected plans and objectives, including the Company’s loan loss reserves and allowance for credit losses related to the COVID-19 pandemic and any expected purchases of its outstanding common stock, and related transactions and other projections based on macroeconomic and industry trends, including expectations regarding and efforts to respond to the COVID-19 pandemic and changes to interest rates by the Federal Reserve and the resulting impact on Origin’s results of operations, estimated forbearance amounts and expectations regarding the Company’s liquidity, including in connection with advances obtained from the FHLB, which are all subject to change and may be inherently unreliable due to the multiple factors that impact broader economic and industry trends, and any such changes may be material. Such forward-looking statements are based on various facts and derived utilizing important assumptions and current expectations, estimates and projections about Origin and its subsidiaries, any of which may change over time and some of which may be beyond Origin’s control. Statements or statistics preceded by, followed by or that otherwise include the words “assumes,” “anticipates,” “believes,” “estimates,” “expects,” “foresees,” “intends,” “plans,” “projects,” and similar expressions or future or conditional verbs such as “could,” “may,” “might,” “should,” “will,” and “would” and variations of such terms are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing words. Further, certain factors that could affect Origin’s future results and cause actual results to differ materially from those expressed in the forward-looking statements include, but are not limited to: deterioration of Origin’s asset quality; factors that can impact the performance of Origin’s loan portfolio, including real estate values and liquidity in Origin’s primary market areas; the financial health of Origin’s commercial borrowers and the success of construction projects that Origin finances; changes in the value of collateral securing Origin’s loans; Origin’s ability to anticipate interest rate changes and manage interest rate risk, (including the impact of higher interest rates on macroeconomic conditions, and customer and client behavior); the effectiveness of Origin’s risk management framework and quantitative models; the risk of widespread inflation; Origin’s inability to receive dividends from Origin Bank and to service debt, pay dividends to Origin’s common stockholders, repurchase Origin’s shares of common stock and satisfy obligations as they become due; business and economic conditions generally and in the financial services industry, nationally and within Origin’s primary market areas, including the impact of supply-chain disruptions and labor pressures; changes in Origin’s operation or expansion strategy or Origin’s ability to prudently manage its growth and execute its strategy; changes in management personnel; Origin’s ability to maintain important customer relationships, reputation or otherwise avoid liquidity risks; increasing costs as Origin grows deposits; operational risks associated with Origin’s business; volatility and direction of market interest rates; increased competition in the financial services industry, particularly from regional and national institutions; difficult market conditions and unfavorable economic trends in the United States generally, and particularly in the market areas in which Origin operates and in which its loans are concentrated; an increase in unemployment levels and slowdowns in economic growth; Origin’s level of nonperforming assets and the costs associated with resolving any problem loans including litigation and other costs; the credit risk associated with the substantial amount of commercial real estate, construction and land development, and commercial loans in Origin’s loan portfolio; changes in laws, rules, regulations, interpretations or policies relating to financial institutions, and potential expenses associated with complying with such regulations; periodic changes to the extensive body of accounting rules and best practices; further government intervention in the U.S. financial system; compliance with governmental and regulatory requirements, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and others relating to banking, consumer protection, securities, and tax matters; Origin’s ability to comply with applicable capital and liquidity requirements, including its ability to generate liquidity internally or raise capital on favorable terms, including continued access to the debt and equity capital markets; changes in the utility of Origin’s non-GAAP liquidity measurements and its underlying assumptions or estimates; uncertainty regarding the transition away from the London Interbank Offered Rate (“LIBOR”) and the impact of any replacement alternatives such as the Secured Overnight Financing Rate (“SOFR”) on Origin’s business; possible changes in trade, monetary and fiscal policies, laws and regulations and other activities of governments, agencies and similar organizations; natural disasters and adverse weather events, acts of terrorism, an outbreak of hostilities (including the impacts related to or resulting from Russia's military action in Ukraine, including the imposition of additional sanctions and export controls, as well as the broader impacts to financial markets and the global macroeconomic and geopolitical environments, regional or national protests and civil unrest (including any resulting branch closures or property damage), widespread illness or public health outbreaks or other international or domestic calamities, and other matters beyond Origin’s control; and system failures, cybersecurity threats or security breaches and the cost of defending against them. For a discussion of these and other risks that may cause actual results to differ from expectations, please refer to the sections titled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Origin’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) and any updates to those sections set forth in Origin’s subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Origin’s underlying assumptions prove to be incorrect, actual results may differ materially from what Origin anticipates. Accordingly, you should not place undue reliance on any forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Origin does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

The risks relating to the proposed BTH merger include, without limitation, the timing to consummate the proposed merger; the risk that a condition to the closing of the proposed merger may not be satisfied; the parties' ability to achieve the synergies and value creation contemplated by the proposed merger; the parties' ability to promptly and effectively integrate the businesses of Origin and BTH, including unexpected transaction costs, the costs of integrating operations, severance, professional fees and other expenses; the diversion of management time on issues related to the merger; the failure to consummate or any delay in consummating the merger for other reasons; changes in laws or regulations; the risks of customer and employee loss and business disruption, including, without limitation, as the result of difficulties in maintaining relationships with employees; increased competitive pressures and solicitations of customers and employees by competitors; and the difficulties and risks inherent with entering new markets.

New risks and uncertainties arise from time to time, and it is not possible for Origin to predict those events or how they may affect Origin. In addition, Origin cannot assess the impact of each factor on Origin’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Furthermore, many of these risks and uncertainties are currently amplified by, may continue to be amplified by or may, in the future, be amplified by the COVID-19 pandemic and the impact of varying governmental responses that affect Origin’s customers and the economies where they operate. All forward-looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Origin or persons acting on Origin’s behalf may issue. Annualized, pro forma, adjusted, projected, and estimated numbers are used for illustrative purposes only, are not forecasts, and may not reflect actual results.

Contact:

Investor Relations

Chris Reigelman

318-497-3177

Media Contact

Ryan Kilpatrick

318-232-7472

![]()