DEALING WITH FRAUD AND NOT SURE WHAT TO DO NEXT?

Whether you notice suspicious transactions, your card has been lost or stolen, or you worry your identity has been compromised, we’re here to help. Click here to view common scenarios and tips on what to do.

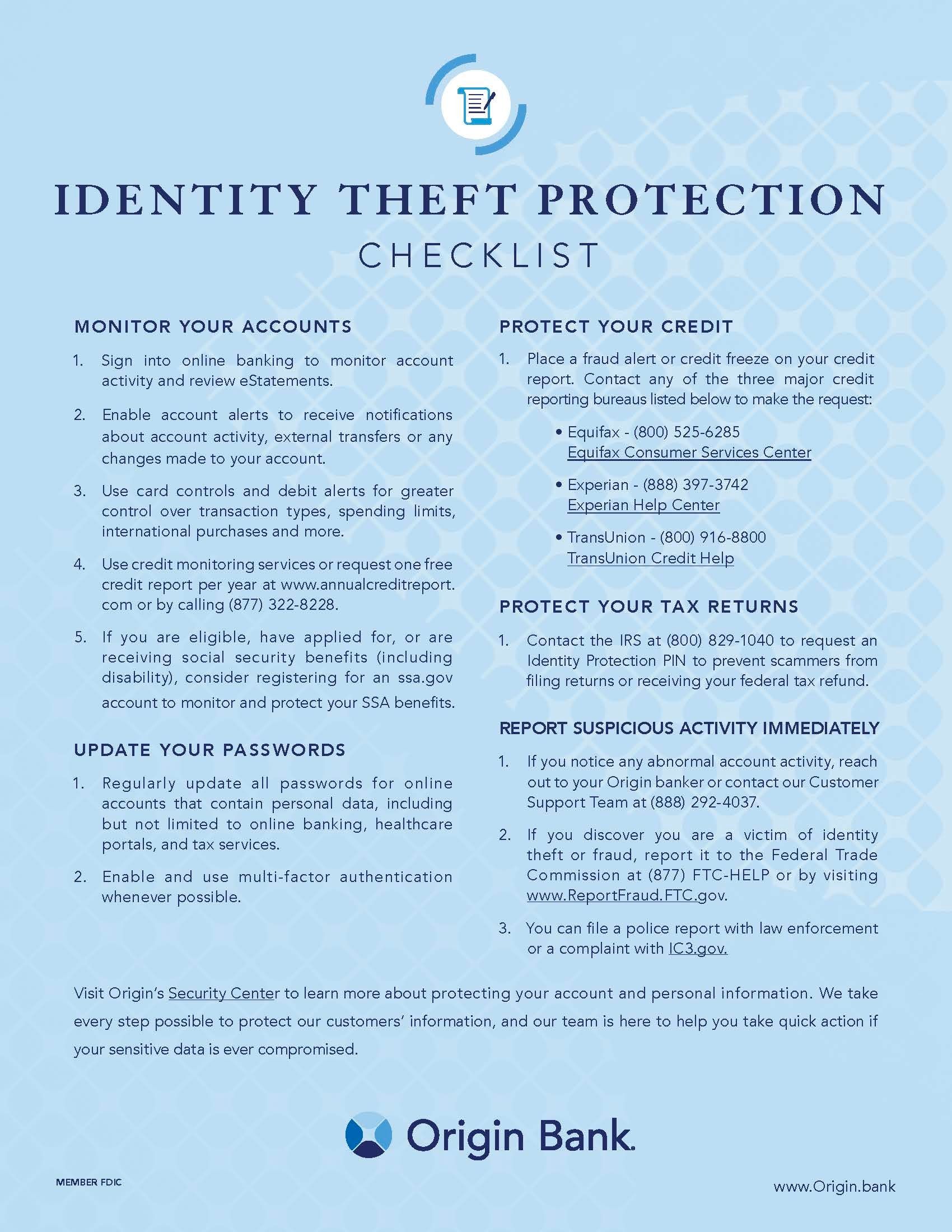

Security Center

Fraud Prevention, Protection and Resolution

Your safety and security are critically important to us. We take every step possible to help you protect yourself from scams and theft. Learn more about how to stay safe and what to do if you experience fraud.

Taking Care to Guard Your Cards

If your debit card is lost, you can quickly freeze it through our app to prevent unauthorized purchases. If you find your uncompromised card, simply unfreeze it with the same ease.

Sign up for Origin Bank debit alerts to receive text or e-mail notifications of card activity. Customize your notification settings to receive certain types of alerts, such as out-of-state transactions, card status changes, or funds transferred. Debit alerts can be set up at no cost for any Origin Bank debit card.

Take screenshots and photos of suspected fraudulent messages to help later investigations or prosecution.

- Sign up for eStatements to avoid physical mail theft.

- Use verified webmail providers.

- Create strong, unique passwords with numbers and symbols.

- Keep an eye out for email security headers.

- Use multifactor authentication when available.

- Monitor account activity frequently.

- Make sure you have dual control over any business critical function if possible.

- Keep operating systems, software, and browsers up to date with the latest patches and updates.

- Install anti-virus software that prevents, detects, and removes malicious programs.

- Use a firewall program to prevent unauthorized access to your PC.

- Back up data on your smartphone or tablet.

- Only use security products from reputable companies.

- Don’t click links in suspicious emails, text messages, or direct messages.

- Be careful when and how you connect to the Internet, and avoid entering sensitive information while using public wi-fi.

- Never act on unexpected requests to send money or make purchases. Always contact the requestor through a different, trusted channel to verify the legitimacy of the request.

Protect Your Business

Keep your business safe by taking measures to prevent corporate account takeovers. At Origin Bank, we take every step we can to make sure our customers' bank accounts are secure 24/7.